Chainflip will flip the DEX Game!

The omnichain future is finally here 🫡

Introduction

Hi, dear member of the Racing Crypto Club 🤝

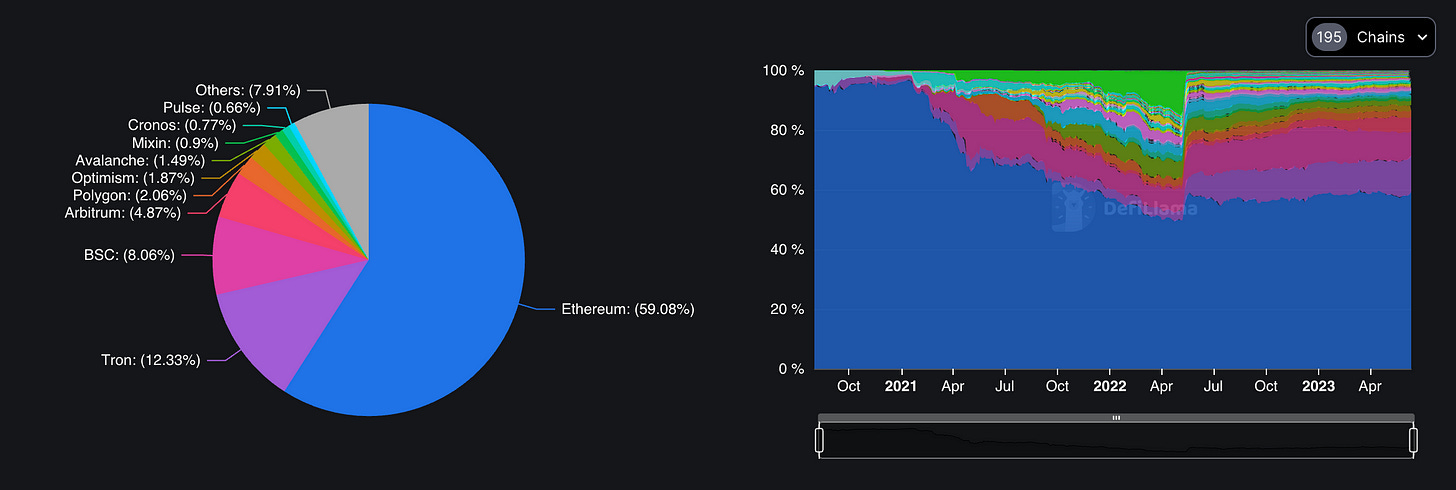

In the current state of the cryptocurrency world, the diversity of blockchain networks is both a boon and a challenge. On the one hand, it's exciting to have so many different chains, each with unique features, capabilities, and currencies. They open up new opportunities and enable a more decentralized and diversified financial system.

However, the more we engage with this multi-chain universe, the more we see the challenges it brings. Primarily, the lack of interoperability between these chains makes exchanging cryptocurrencies more complicated than it should be. This limitation is primarily because each blockchain operates in its own world, unable to communicate directly with others. And it gets even worse with chains like Bitcoin or Doge as they are completely isolated.

Typically, if you wanted to exchange Bitcoin (which operates on the Bitcoin blockchain) for Ethereum (which operates on the Ethereum blockchain), you would have to rely on centralized exchanges. This process often involves paying high fees, enduring lengthy transaction times, and handing over control of your assets to a third party. Another way would involve bridging and swapping including high slippage which doesn’t make it any better. This is where Chainflip comes into play. This new technology aims to streamline cross-chain trading and swapping by allowing users to directly swap cryptocurrencies from different blockchains without the need for centralized intermediaries or the constraints of a single blockchain. Btw, with Chainflip you can forget about wrapped tokes, everything is native. It offers a revolutionary way to navigate the increasingly diverse and complex landscape of digital assets, bringing us one step closer to truly frictionless and decentralized trading.

In the next section, we'll dive into the nuts and bolts of how Chainflip works and how it solves the cross-chain trading puzzle!

Understanding Chainflip

To fully appreciate the game-changing potential of Chainflip, we need to delve into how it works. As we have already established, Chainflip's main mission is to facilitate direct swaps of cryptocurrencies across different blockchains without relying on centralized intermediaries. But how does it accomplish this?

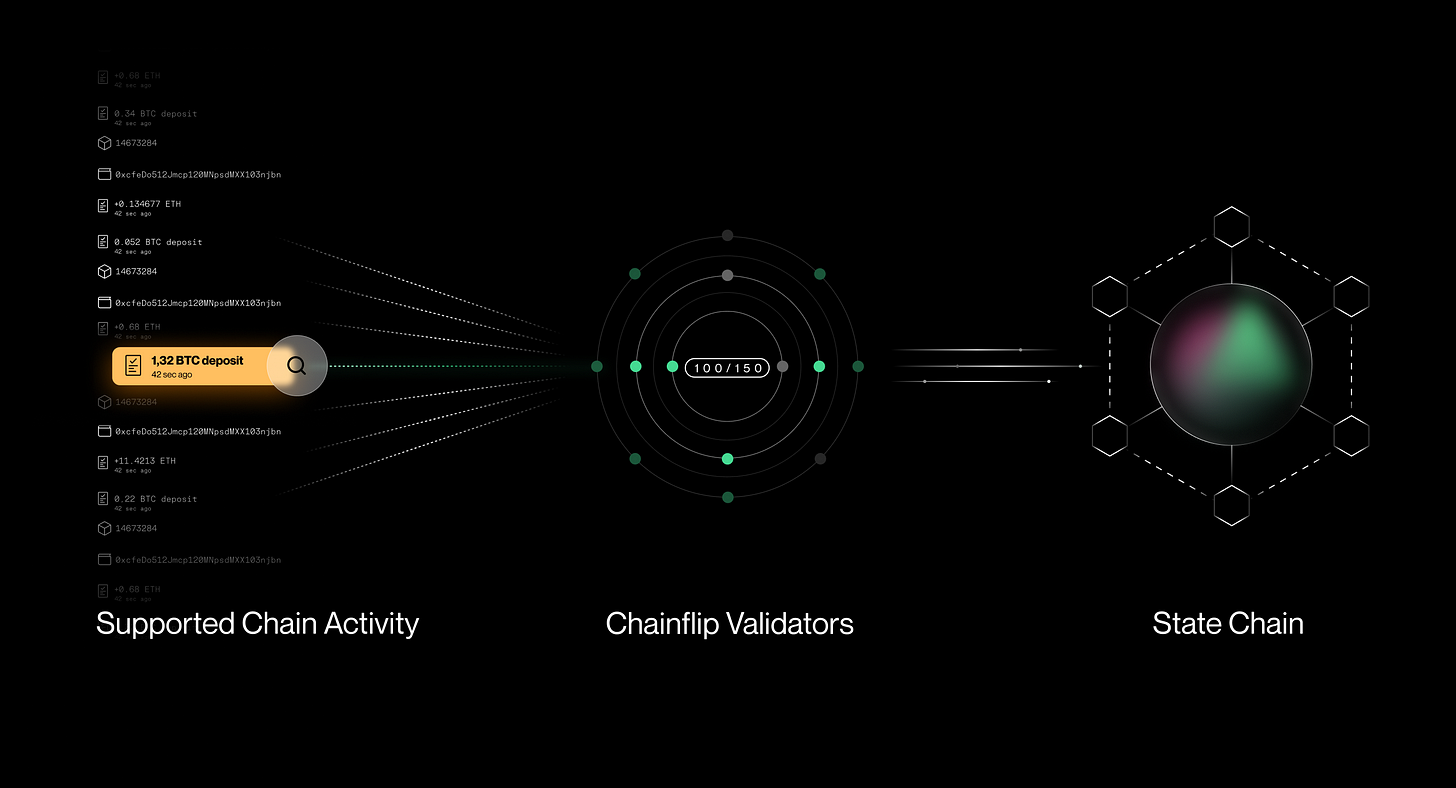

Chainflip utilizes an innovative network infrastructure known as the State Chain, a separate blockchain network that integrates with existing blockchains, enabling them to communicate and interact with each other. The State Chain is a dynamic and flexible blockchain, which allows it to support the various native operations of the connected blockchains.

One crucial aspect of Chainflip is that it doesn't require smart contract functionality on the blockchain it interacts with. For instance, Bitcoin, one of the most popular but least flexible cryptocurrencies in terms of programmability, can be seamlessly integrated into the State Chain.

To support the liquidity in the State Chain you can deposit different assets, which is made possible by the use of Vaults. These are multi-signature wallets on each integrated blockchain that safely store users' assets. This is made possible by the Threshold Signature Scheme (TSS) which enables fast and scalable multi-party signing for a set of 150 validators. When a user wants to make a cross-chain swap, they send their assets to a Vault. These tokens will just sit there while the swap will happen.

To illustrate it, if a user wants to swap Bitcoin for Ethereum, they would send their Bitcoin to a Bitcoin Vault. The Vault then just holds the deposited $BTC and the State Chain executes a swap of $BTC for $USDC and then $USDC for $ETH. After the swap is completed you will get your native $ETH from the Ethereum vault, no wrapping is needed!

In the upcoming section, we'll delve into how Chainflip manages liquidity and maintains a fair and stable trading environment. Stay tuned!

The Power of Liquidity in Chainflip

The development of Chainflip is not just another entry into the decentralized exchange landscape—it's a potential game changer for the crypto ecosystem at large. Its cross-chain compatibility addresses one of the most challenging problems in decentralized finance: liquidity fragmentation. Currently, most digital assets are confined within their native blockchain ecosystems. Trading these assets often necessitates moving them across different exchanges, each with its own set of fees, transaction times, and security risks.

Chainflip simplifies this process by offering a one-stop shop for swapping digital assets across various blockchain ecosystems. It effectively unites these fragmented liquidity pools into a singular, potent reservoir. This unified pool not only facilitates more efficient and potentially cost-effective transactions, but it also has the potential to boost the liquidity and market depth of less popular or emerging cryptocurrencies. This can make the entire ecosystem more robust, providing improved price stability and fostering an environment that encourages the development of more diverse and innovative crypto projects.

Moreover, Chainflip’s automated liquidity management offers a significant advantage over existing models. Its novel Virtual Automated Market Maker (vAMM) approach ensures there is a constant liquidity provision, irrespective of the chain where the asset originates. This can make it more attractive for investors and traders, contributing to the overall growth and dynamism of the crypto space.

In essence, the emergence of Chainflip could be a significant milestone in the evolution of the decentralized finance ecosystem. It empowers users with more control and flexibility in managing their digital assets, making the crypto space more accessible, efficient, and engaging.

Implications for the Crypto Ecosystem

Liquidity is the lifeblood of any financial market, and the world of cryptocurrencies is no exception. Without sufficient liquidity, traders may not be able to buy or sell assets at the desired price or in the required quantities. In traditional crypto exchanges, liquidity is often fragmented, with each pair of assets having its own separate pool. This segmentation can lead to inefficiencies and price discrepancies.

This is where Chainflip truly shines. By consolidating the liquidity of all supported cryptocurrencies into a single pool, Chainflip achieves superior efficiency and helps maintain price stability. This is made possible by Chainflip's unique liquidity mechanism.

But how does it work? As we discussed earlier, when a user deposits an asset into a Vault, the asset is frozen and an equivalent amount of representative tokens are minted on the State Chain. These representative tokens then become part of the single, aggregated liquidity pool, where they can be swapped for any other asset in the pool.

To add to its robust liquidity mechanism, Chainflip employs the concept of Just in Time Automated Market Maker (JIT AMM). The JITAMM plays a pivotal role in facilitating and maintaining the aggregated liquidity pool. JIT AMM is like a special playtime where everyone can fairly exchange their tokens simultaneously. This allows for fair trade and ultimately reduces the slippage.

In the next part, we'll discuss the potential implications of Chainflip on the broader crypto ecosystem and why it could revolutionize the way we trade cryptocurrencies. Don't miss it!

Chainflip's Unique Technology and Process

One of the most exciting aspects of Chainflip is the technology that powers it. It uses a cross-chain, decentralized automated market maker (AMM) protocol. This means it has a system that allows the automated buying and selling of digital assets across multiple blockchain networks.

As you may know, Bitcoin does not natively support smart contracts, which could be a roadblock when trying to include Bitcoin liquidity on a decentralized exchange. Chainflip ingeniously gets around this issue. When you want to provide liquidity with Bitcoin, you send it to a secure Chainflip State Chain, the process is very user-friendly and similar to Uniswap.

By doing this, Chainflip has unlocked the potential for greater use of the currently inactive Bitcoin liquidity in the DeFi space. This isn't limited to just Bitcoin. The same process can be applied to other digital assets that don't natively support smart contracts.

This approach of Chainflip allows for greater decentralization and compatibility within the crypto space. In turn, it opens up the possibility for more comprehensive, seamless, and efficient transactions for users across different blockchain networks.

Finally, Chainflip is not just about technology. It's about community as well. The platform is governed by FLIP token holders who decide on key operational aspects, reinforcing the decentralized ethos that underpins the project.

Next time, we'll talk about how you can participate in Chainflip as a user, whether you're looking to swap assets or become a liquidity provider. So stay tuned!

Be sure to check out the docs for more info on it!

Participating in Chainflip

Now that we've delved into the technology behind Chainflip, let's take a closer look at how you, as a user, can participate in this innovative ecosystem.

To start swapping assets on Chainflip, the process is refreshingly straightforward. If you've used any other decentralized exchange before, you'll find it quite familiar. You simply need to connect your wallet to Chainflip and select the asset you want to swap, and the asset you want to receive. The platform will calculate the rate, and once you confirm the transaction, the swap is initiated and finalized in a couple of seconds. It's that simple!

As a liquidity provider, the process is just as simple. You can deposit your digital assets into the Chainflip liquidity pools to earn passive income from trading fees. As we explained earlier, even if your assets don't natively support smart contracts like Bitcoin, Chainflip makes it possible to include them in the liquidity pool.

By depositing your Bitcoin (or any other asset) into a Chainflip state chain, you're rewarded with $FLIP tokens on the Chainflip network. These tokens represent your assets and are what get used in the liquidity pool. The more liquidity you provide, the more you stand to earn from trading fees.

In our next section, we'll discuss the security measures that Chainflip has in place to protect your assets and ensure trust in the platform. Stay tuned!

Security and Trust in Chainflip

When dealing with digital assets, security is paramount. As we know, cryptocurrencies can be quite volatile, and the last thing any investor wants is to lose their hard-earned assets due to a breach. This is why Chainflip has gone above and beyond to implement robust security measures that ensure the utmost safety of your funds.

As we mentioned earlier Chainflip uses so-called Vaults to store the funds and operate between the chains. There are 2 different versions of vaults that are used to store AMM funds:

Smart Contract Vault

Native Wallet Vault

Let’s cover each one of them. The Vault Smart Contract can send funds with an approval of an aggregate key, which is controlled by the Authority Set in a 100 of 150 threshold signature scheme (FROST). On the other hand, a native wallet vault is just a native wallet also controlled by Authority Set in a 100 of 150 threshold signature scheme (both handled off-chain).

One of the unique security features of Chainflip is the use of threshold signatures for its validators. Instead of relying on individual signatures, Chainflip uses a collection of signatures from multiple validators to confirm transactions. It’s being realized using so-called “Validator Auctions”. Each Validators Epoch is 3 hours long and on halfway through the current Epoch, the Validators start bidding with $FLIP on Ethereum to be a part of the next Authority Set. If a Validator’s bid is higher than or equal to the Minimum Active Bid at the end of the active Auction, that Validator becomes a part of the Primary selection group for KeyGen.

This makes the network extremely resilient to attacks, as an attacker would need to compromise more than half of the validators to affect the network - a feat that is statistically almost impossible.

Lastly, to foster trust in the platform, Chainflip maintains a high level of transparency. Every transaction that takes place within the network is publicly verifiable. It’s very similar to the Etherscan where you can easily check every transaction on the State Chain. This level of transparency allows users to independently confirm that their transactions have been processed correctly.

In the final part of this newsletter, we will explore the future of Chainflip, its plans for scalability, and how it is positioning itself to become a key player in the growing decentralized finance (DeFi) space. So, don’t go away just yet!

The Future of Chainflip: Scalability and DeFi

The world of cryptocurrency is ever-evolving, and in order to stay competitive, platforms need to be able to adapt and grow. Chainflip has been built with this in mind. Its innovative architecture allows it to handle a high volume of transactions, ensuring that it can scale up as the demand for cross-chain swapping increases.

Not only that, but Chainflip is also positioning itself to become a crucial player in the rapidly growing DeFi sector. With its ability to connect different blockchains seamlessly, it offers a significant advantage to DeFi projects. This enables developers to create decentralized applications that aren't limited to one blockchain but can take advantage of the unique benefits of different blockchains.

In terms of future developments, Chainflip aims to continually integrate more blockchains into its network, further increasing the scope and utility of its platform. The team is also focused on improving user experience and reducing the technical barriers that may prevent ordinary users from taking full advantage of the DeFi space.

The next step on the roadmap would be Mainnet Initialisation with the validators’ networks going live on the mainnet. From the very start, the network will be secure and decentralized with the $FLIP token staking to be implemented later. With the launch of Mainnet, the $FLIP token is required to launch first and you can expect announcements about this very soon. I will make sure to keep you updated, racers!

Conclusion

As we've discussed throughout this newsletter, Chainflip is breaking down the barriers between different blockchains. This revolutionary platform is setting new standards for blockchain interoperability, enabling seamless cross-chain swaps and fostering growth in the DeFi sector.

But Chainflip isn't just a platform; it's a community. A community of developers, users, and advocates who believe in the potential of decentralized finance and are working together to make it more accessible to everyone, everywhere.

Visit the website to learn more about Chainflip, sign up for the newsletter to stay updated on the latest developments, and join community forums to engage in discussions with like-minded individuals. Let's flip the chains!