Introduction

The decentralized finance (DeFi) sector has revolutionized the way we interact with financial systems, pushing the boundaries of traditional finance into a world of trustless and permissionless innovation. Amidst a plethora of DeFi protocols, a name that has gained significant attention is Frax Finance.

Frax Finance is the world's first fractional-algorithmic stablecoin system, which has set out to solve the critical problems faced by traditional and algorithmic stablecoins. But what sets Frax apart is its unique amalgamation of both collateralized and algorithmic approaches, offering a robust and adaptive stablecoin, FRAX, that dynamically adjusts its underlying collateral ratio based on market conditions.

This ecosystem doesn't stop at FRAX. It comprises several innovative financial instruments like Fraxswap, Fraxlend, FPI, frxETH, veFXS, Gauge Staking, Fraxferry, and Algorithmic Market Operations (AMOs), which altogether provide a comprehensive solution to various DeFi needs. Furthermore, Frax has established partnerships with multiple industry leaders, contributing to the evolution of its ecosystem and strengthening its market position.

In this in-depth article, we will dive into the heart of the Frax ecosystem, unraveling each financial instrument and understanding the intricate connections that form the backbone of Frax Finance. Our exploration will cover everything from the basics of these instruments, their purpose, their interdependencies, and their impact on the Frax ecosystem, providing you with a comprehensive understanding of Frax Finance.

Fasten your seatbelts as we embark on this journey to decode the mechanics of one of the most innovative DeFi projects in the crypto sphere.

Core Concept: $FRAX

As we already mentioned Frax ecosystem covers multiple financial instruments, each being widely used widely adopted. Nevertheless, everything is still built around the $FRAX - bloodline system of the Frax Finance organism. In this part, we will dive deep into how $FRAX works, the mechanism behind it, the yield it generates, and much more.

Understanding $FRAX

FRAX is a unique stablecoin that presents an innovative solution to some of the most critical challenges faced by stablecoins. It adopts a fractional-algorithmic approach, representing a new generation of stablecoins that bring together the best features of collateralized and algorithmic stablecoins.

The underlying principle of FRAX is a dynamic collateral ratio, which adjusts based on market conditions. When the demand for FRAX increases, and its price exceeds $1, the system decreases the collateral ratio. This decrease allows for the generation of more FRAX tokens, facilitating supply to meet the increased demand. Conversely, if the price of FRAX drops below $1, indicating lower demand, the system increases the collateral ratio, which reduces the FRAX supply, thereby restoring the price peg.

This innovative approach ensures that FRAX remains pegged to the US dollar while leveraging the benefits of both collateralization and algorithmic mechanisms.

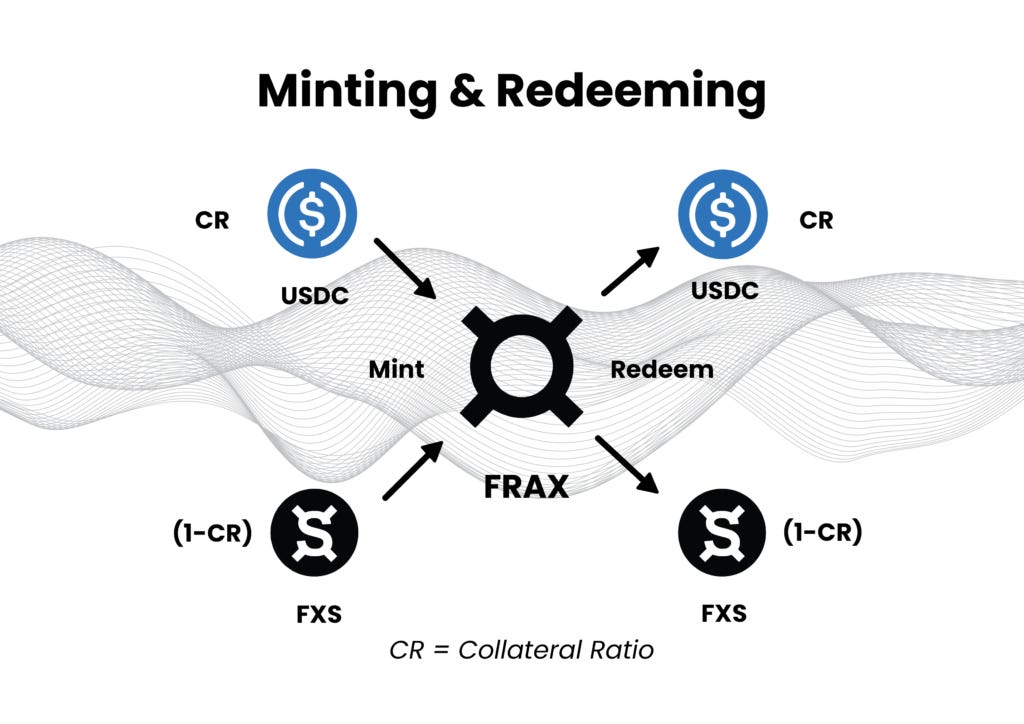

The Minting Process

The creation of a new FRAX involves a unique minting process tied to the collateral ratio. When users want to create FRAX, they send collateral, primarily USDC, and Frax Shares (FXS) to the pool contract. The required amounts of collateral and FXS are determined by the current collateral ratio (CR). For instance, at a 94.75% CR, users would need $0.9475 in USDC and $0.0525 in FXS to mint 1 FRAX.

This dynamic minting process ensures that the supply of FRAX adapts to market demands, maintaining its peg to the US dollar.

Path Toward 100% Collateralization

Interestingly, Frax Finance has a strategic roadmap toward achieving 100% collateralization. This means that eventually, users will mint 1 FRAX by depositing 1 USDC, turning FRAX into a fully-backed stablecoin. This collateral, in turn, will be invested in various DeFi yield protocols through the investor AMO, generating revenues that would initially be used to achieve 100% CR and then flow to veFXS holders.

This small algorithmic backing of FRAX creates the perception of $FRAX being a less safe option to be held long-term, especially after the fall of LUNA and $UST. The way to increase CR to 100% would be through retaining and increasing the protocol earnings, so the FXS buybacks will be held until the CR will reach the full 100%. The collateral will be deposited to the Investor AMO but more on it later 👀

The proposal was passed almost unanimously, feel free to read more on it here.

The Role of FRAX in the Frax Finance Ecosystem

FRAX serves as the cornerstone of the Frax Finance ecosystem, interacting with other financial instruments and platforms within the system. It forms the base asset in Fraxswap and Fraxlend, participates in the minting of the FPI token, forms a part of the rewards in the Gauge Staking mechanism, and has a critical role in the operations of Fraxferry and the AMOs.

In the sections that follow, we will delve deeper into these platforms and instruments to understand their functionalities and their interactions with $FRAX.

Frax Price Index

The Frax Finance ecosystem has added another novel stablecoin to its portfolio - the Frax Price Index (FPI). FPI is the first stablecoin to be pegged to a basket of real-world consumer items, defined by the US CPI-U average. This ensures that its price remains constant to the price of all items within the CPI basket, maintaining its purchasing power via on-chain stability mechanisms, similar to the FRAX stablecoin.

In an innovative approach to monetary policy and decentralization, the FPI uses the unadjusted 12-month inflation rate as reported by the US Federal Government. This inflation rate data is committed to the chain immediately upon its public release by a specialized Chainlink oracle, applying to the redemption price of FPI stablecoins in the system contract. This price grows or declines per second on-chain, depending upon the inflation or deflation rate. This ensures the FPI peg is always tracking the 12-month inflation rate.

Frax Price Index Share (FPIS):

The Frax Price Index Share (FPIS) token is the governance token of the system, which is also entitled to seigniorage from the protocol, similar to the FXS structure. Any excess yield generated is directed to FPIS holders from the treasury. The FPIS token also directs a variable part of its revenue to FXS holders, reinforcing the interconnected nature of the Frax ecosystem.

FPI Stability Mechanism:

The FPI uses the same type of AMOs as the FRAX stablecoin but always maintains a 100% collateral ratio (CR). To keep the CR at 100%, the protocol's balance sheet must grow at least at the rate of CPI inflation. If the AMO yield is less than the CPI rate, the TWAMM AMO will sell FPIS tokens for FRAX stablecoins to maintain the CR at 100%.

FPIS Token Distribution:

The FPIS has a total supply of 100,000,000 FPIS and cannot be minted over this Genesis supply except to keep the FPI peg to the CPI rate and maintain the CR constant at 100%. The distribution of FPIS is carefully planned with proportions allotted for Frax Finance Treasury, FPI Protocol Treasury, veFPIS emissions, Core Developers & Contributors Treasury and an initial airdrop to FXS holders.

veFPIS: An Updated and Modular System

veFPIS is an updated vesting+yield system for the FPIS governance token. Users can lock their FPIS for up to 4 years and receive up to four times the amount of veFPIS. Additional DeFi whitelist features can be approved by governance, allowing for extended functionalities such as "slashing conditions" and new ways to earn higher yield by controlling liquidity deployment, voting on CPI gauge weights, or borrowing FPI.

Overall, the introduction of the Frax Price Index (FPI) marks a significant step forward in creating a decentralized and real-world connected monetary policy in the DeFi landscape. It combines the strengths of algorithmic and collateralized approaches with the stability of a consumer price index, providing a strong foundation for value exchange in the DeFi ecosystem.

$frxETH

Frax Finance is expanding its ecosystem by introducing Frax Ether, a system specifically designed to maximize staking yield and streamline the Ethereum staking process in a DeFi-native manner. The system comprises three primary components: Frax Ether (frxETH), Staked Frax Ether (sfrxETH), and the Frax ETH Minter.

Frax Ether (frxETH):

Frax Ether (frxETH) serves as a stablecoin loosely pegged to the value of ETH. The primary purpose of frxETH is to integrate ETH into the Frax ecosystem. FrxETH is akin to holding ETH, with the added advantage of being part of the Frax ecosystem, allowing for greater composability and integration within DeFi.

Staked Frax Ether (sfrxETH):

sfrxETH is the yield-earning version of frxETH. It is designed to accrue the staking yield from the Frax Ether validators. All profits generated from Frax Ether validators are distributed among sfrxETH holders. By converting frxETH into sfrxETH, users become eligible for staking yield, which can be claimed upon converting sfrxETH back to frxETH. This system shares similarities with other auto-compounding tokens, such as Aave's aUSDC and Compound's cUSDC.

Frax ETH Minter (frxETHMinter):

The frxETHMinter is a smart contract that exchanges ETH for frxETH. It accepts ETH, mints an equivalent amount of $frxETH, and, whenever possible, spins up new validator nodes. This system helps to onboard ETH into the Frax ecosystem.

Liquid Staking

The Frax Ether system aims to address the complexity and limitations of solo ETH staking, which involves technical knowledge, initial setup, and requires a 32 ETH deposit. Instead, Frax Ether provides a more flexible and user-friendly solution. It allows users to earn a yield on any amount of ETH, offers withdrawals at any time and almost any size, and enhances composability throughout DeFi.

After depositing 1 $ETH to Frax user mints 1 $frxETH. The same as with other LSD providers the user has different options:

Staking $frxETH for $sfrxETH and receiving the yield (staked $frxETH will be used in Curve for minting $crvUSD, more on the Frax - Curve partnership later)

Deposit into the $ETH/$ftxETH LP on Curve for example and get fess and $CRV rewards.

Use it as collateral or any other use cases.

Important to mention is that 2% of the POS rewards are going to the so-called “Slashing Insurance Fund” and another 8% to the Frax Treasury, where the revenue will be distributed between veFXS holders. We will cover the $FXS in the next section.

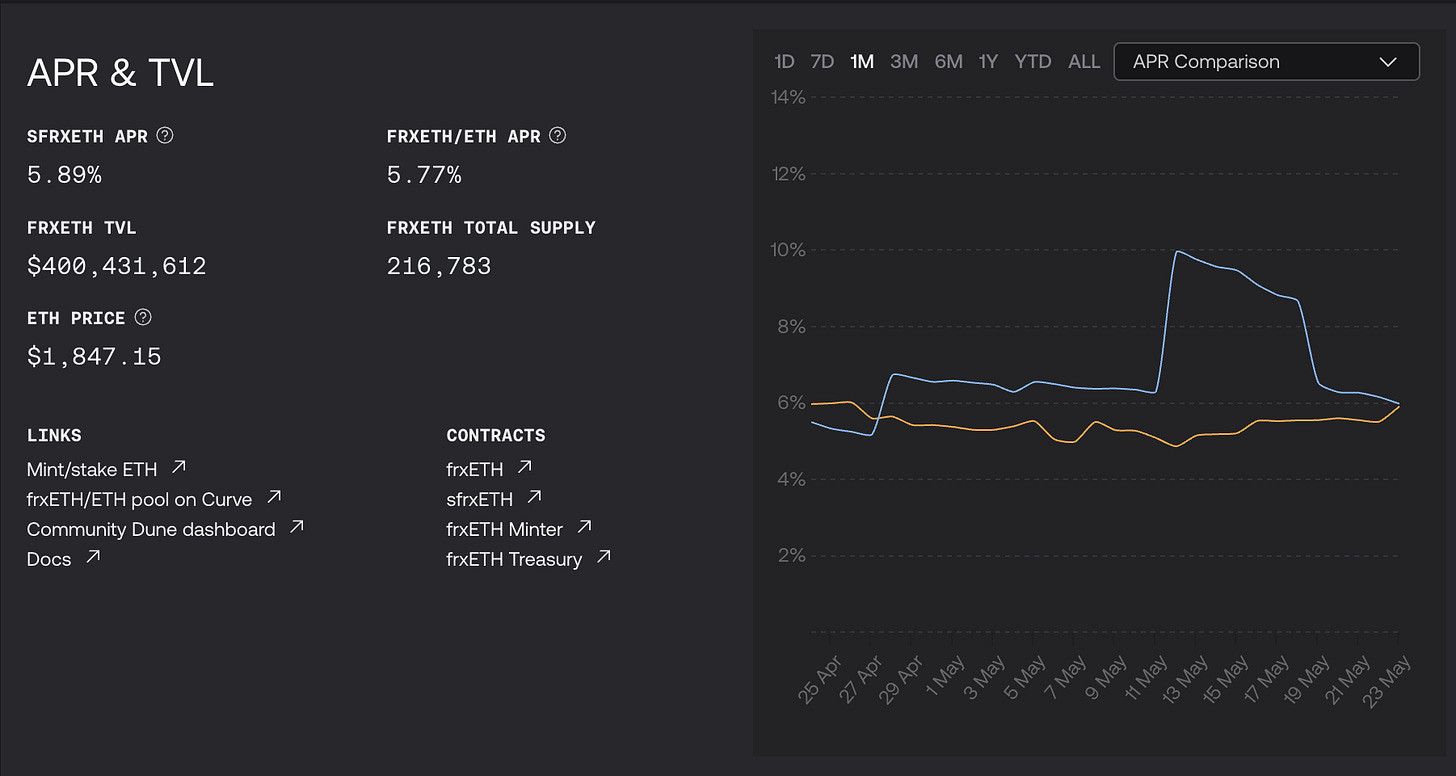

As of today the APR rates for $sfrxETH and the LP Pair are very similar but just a week ago staking was much more rewarding.

Frax is seeing steady growth in the total $frxETH with $sfrxETH being the most popular way of using it. The thing is that when u swap the $ETH for the $frxETH is automatically used to spin up a POS node. So all ~216k of ETH are getting yield which is being distributed between ~146k of $sfrxETH staked.

That’s the exact reason why the APY of $sfrxETH is always higher compared to other LSD providers such as Lido and Rocket Pool. Now u don’t need to wonder if it’s some kind of magic trick that Frax offers such high APY compared to others, the rewards are just being differently distributed which lefts $ftxETH stakers with more $ETH in their pocket.

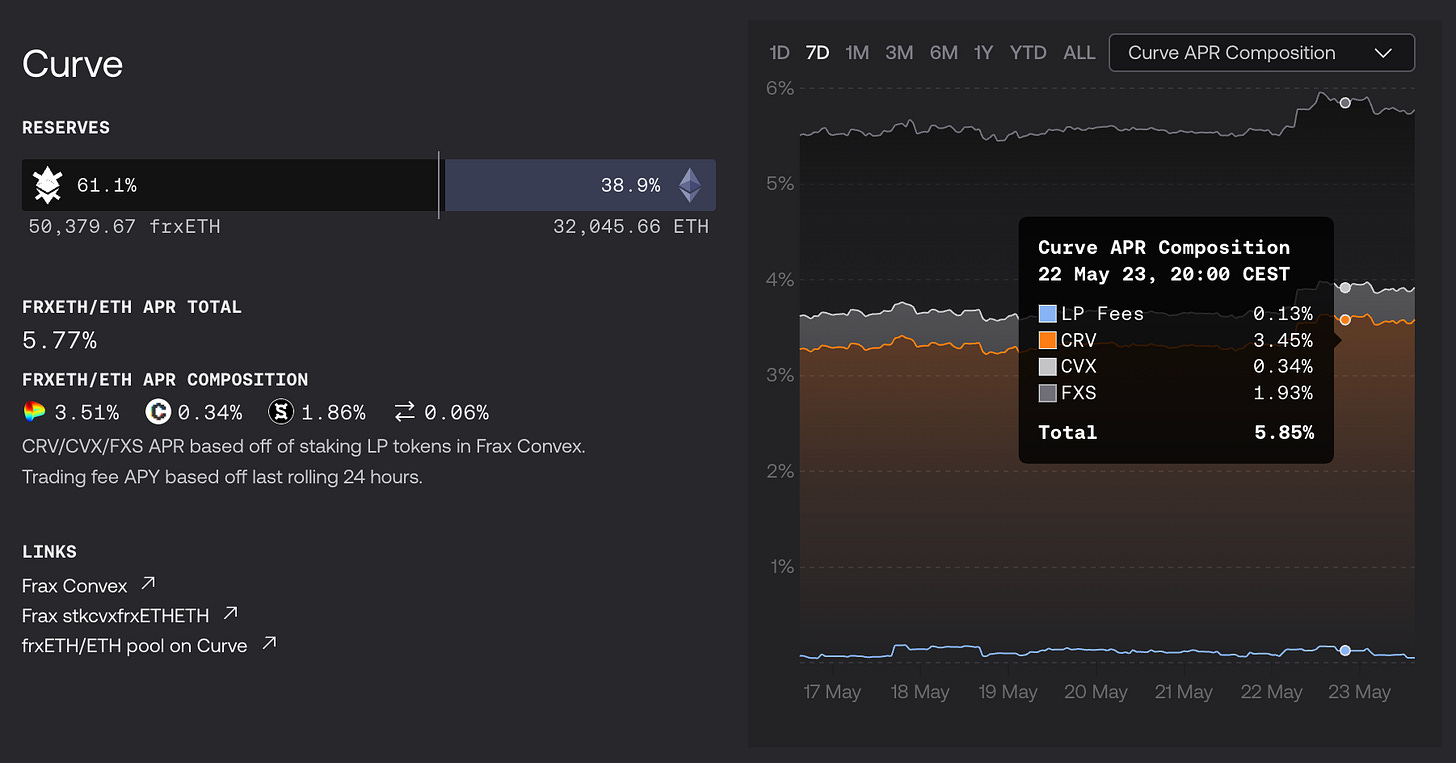

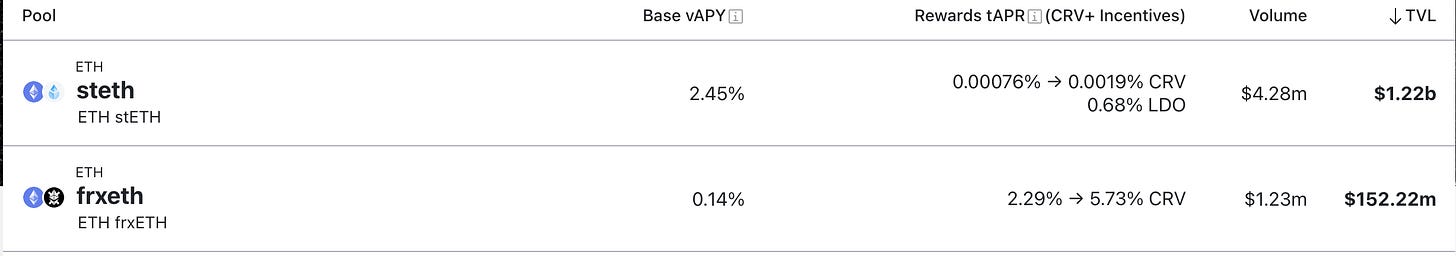

Here we can see a more detailed Curve LP overview. LP Fees are a fraction of the Pool APR as the users are being incentivized with $CRV, $CONVEX, and $FSX rewards. The Pair must be liquid so the incentivizes are attracting liquidity.

Still must mention that the difference between Lido’s $stETH and $ftxETH is massive. Nevertheless, Frax is being offered better Liquidity for its size compared to Lido.

Lido’s LSD share according to DefiLlama is 73.31% and Frax has only 2.39% which results in a 30.67 times difference. The TVL difference in the Lido Pools is only 8 times, which means that with a much smaller size, Frax is being to offer much more Liquidity for its users. The Defi Ecosystem of $stETH is still much more developed, which means that the liquidity is just being distributed around different protocols.

Feel free to check out the overall state of LSDs and particularly Frax.

Technical Specifications:

Frax Ether system is built with rigorous technical considerations, ensuring compliance with established standards. FrxETH implements the ERC-2612 standard, allowing spender approvals to be made via ERC-712 signatures.

The frxETHMinter mints frxETH when it receives ETH and spins up a new validator whenever its balance exceeds 32 ETH. Moreover, it provides redundancy to ensure validators with incorrect parameters won't be accepted.

Market Making Across DeFi:

The Frax Ether system includes provisions for market making. A proportion of funds can be withheld when ETH is submitted, which is then used to ensure liquid markets for frxETH across DeFi. This serves to further integrate frxETH into the broader DeFi ecosystem.

In conclusion, Frax Ether is an innovative approach that bridges Ethereum staking with DeFi. It's designed to smoothen the staking process and maximize yield while retaining the stability and security attributes inherent in the Frax ecosystem.

Fraxswap

The next stop on our journey through the Frax Finance ecosystem is FraxSwap, an Automated Market Maker (AMM) that serves as a cornerstone for transactions within the ecosystem.

Introduction to FraxSwap

FraxSwap is a decentralized exchange on the Ethereum blockchain, built specifically for the Frax ecosystem. It follows the AMM model that allows for trustless token swaps and provides users with the ability to earn yields by providing liquidity to different pools.

The Role of FRAX in FraxSwap

At the heart of FraxSwap is FRAX. As the native stablecoin of the Frax Finance ecosystem, FRAX is often one-half of the token pairs available for swapping. This ensures that users have a stable and reliable medium of exchange when transacting on FraxSwap. Whether users want to swap between FRAX and another token or provide liquidity to earn yields, FRAX's stable value is crucial in ensuring predictable and secure transactions.

Swapping and Liquidity Provision on FraxSwap

FraxSwap works like other AMMs with a couple of notable features. Users can swap tokens directly from their wallets, using FRAX as one of the tokens in the swap. The swapping process is straightforward - users select the tokens they want to swap, and the amount, and the transaction gets executed based on the current exchange rate, factoring in any applicable fees.

For those who have idle assets and wish to earn passive income, FraxSwap offers an attractive opportunity through liquidity provision. Users can provide liquidity to various pools and earn transaction fees. Each transaction on FraxSwap incurs a small fee (0.3%), which is distributed to the liquidity providers of the relevant pool, proportional to their share.

Integrating with the Broader Frax Ecosystem

FraxSwap is deeply integrated with the wider Frax ecosystem. It works seamlessly with Fraxlend to offer borrowing and lending services and interacts with the Frax Shares system (FXS & veFXS) to enable voting and governance. In addition, users can use FraxSwap to acquire FRAX for staking in gauges and use within the Fraxferry system and the various AMOs.

FraxSwap not only provides users with a platform to swap tokens and provide liquidity but also plays a vital role in connecting various elements of the Frax ecosystem. By ensuring a seamless flow of tokens and providing a platform for earning passive income, FraxSwap significantly contributes to the growth and utility of the Frax Finance ecosystem.

Fraxlend

At the heart of Fraxlend are pairs of ERC-20 tokens. Each pair forms an isolated market, enabling a single token to be borrowed (Asset Token) by depositing a different token (Collateral Token). When lenders deposit Asset Tokens, they receive yield-bearing $fTokens, which represent the lender's share of the total amount of assets in the pair, plus the accrued interest from borrowers. This model ensures that the number of Asset Tokens each $fToken can be redeemed for cannot decrease, meaning that as more interest accrues, lenders can redeem their $fTokens for an ever-increasing amount of the underlying asset.

Borrowers, on the other hand, deposit Collateral Tokens into a pair to borrow Asset Tokens. The interest owed by borrowers is capitalized, causing the amount owed to increase over time. To regain their collateral, borrowers must repay the initial loan amount along with all the accrued interest.

Dynamic Debt Concept

However, Fraxlend introduces an innovative concept called Dynamic Debt Restructuring to handle cases of extreme volatility where liquidations can't occur fast enough. In such scenarios, liquidators repay the maximum possible amount of the borrower's position covered by the collateral. Any remaining debt reduces the total claims that all lenders have on the underlying capital. This mechanism prevents the last lender from holding worthless fTokens (a phenomenon known as "bad debt") and ensures the pair can resume operations immediately after adverse events.

Fraxlend's infrastructure comprises Oracles, Rate Calculators, and the Fraxlend Pair Deployer. Oracles provide a robust and manipulation-resistant price feed, while Rate Calculators adjust the interest rate depending on the amount of available capital to borrow. The Fraxlend Pair Deployer takes care of deploying each pair.

Frax Share

Frax employs a unique staking system through its vesting token called $veFXS. Inspired by Curve's veCRV mechanism, veFXS provides a range of benefits to users who commit to long-term staking of their FXS tokens.

How Does veFXS Work?

Users can lock up their FXS tokens for up to four years, and in return, they receive four times the amount of $veFXS. For example, 100 FXS locked for four years gives you 400 $veFXS. $veFXS is not a transferable token nor does it trade on liquid markets. Instead, it functions as an account-based point system signifying the vesting duration of a wallet's locked FXS tokens within the protocol.

Over time, the veFXS balance linearly decreases as tokens approach their lock expiry, reaching a 1:1 ratio with FXS when the lock time expires. This decay mechanism incentivizes long-term staking and encourages an active, committed community.

$veFXS and Governance

Each veFXS carries one vote in governance proposals. If you stake 1 FXS for the maximum duration of four years, you'll receive 4 veFXS, which means 4 votes in governance. Over the four-year period, the veFXS balance gradually decreases back to 1 veFXS, and at the end of the period, you can redeem your veFXS for FXS tokens.

In addition to being a significant aspect of the governance structure, veFXS also provides users with enhanced farming rewards. Holding veFXS increases the weight of certain farming rewards distributed directly through the Frax protocol. The additional weight does not increase the total emission of rewards, but it increases each farmer's yield proportional to their veFXS balance. This provides another level of incentive for users to lock up their FXS tokens and engage with the ecosystem for a more extended period.

The Future of $veFXS

Looking ahead, the veFXS system offers potential for further expansion and integration. It can be used for voting on AMO weights, earning additional yield in new features or areas, and helping create long-term alignment for the Frax Finance economy. By giving voting power to long-term FXS holders and incentivizing gauge farmers to stake FXS, veFXS helps maintain a robust and engaged Frax community. Furthermore, it allows DAOs and other projects to build a substantial, long-term veFXS position and actively participate in Frax governance. This multifaceted approach helps to establish a bond-like utility for FXS and creates a benchmark APR rate for staked FXS.

Gauge Staking

In the Frax Finance ecosystem, a "gauge" is a unique type of farming smart contract designed to incentivize specific behaviors that benefit the overall protocol. It is the main instrument controlling FXS emissions, and it offers rewards to users who deposit certain assets.

Understanding the Gauge System

At its core, a gauge is a smart contract where you deposit an asset, such as a liquidity pool (LP) token, a vault token, or even an NFT, and in return, you receive yield in the form of FXS and potentially other tokens. The type of deposits a gauge accepts can vary, covering options like FRAX lending deposits (aFRAX in Aave, cFRAX in Compound, fFRAX in Fraxlend), LP tokens (from Curve or Fraxswap), or NFTs (like Uniswap v3 NFT positions). This system encourages actions that are beneficial to the protocol, such as increasing FRAX lending, boosting the liquidity of certain pairs, or expanding partnerships with other projects.

The amount of FXS allocated to each gauge strategy is determined by its "gauge weight," which can be influenced by veFXS holders' voting power. If you're a $veFXS holder, you can distribute your voting power across multiple gauges or focus it on a single gauge. This system ensures that the most committed users of the protocol, those who stake their FXS for the long term, have control over the future FXS emission rate.

Types of Gauges in the Frax Ecosystem

There are different types of gauges within the Frax ecosystem, each targeting a specific type of deposit and incentivizing certain behaviors:

LP Gauge: This type of gauge accepts ERC20 LP tokens as a deposit and is the most common gauge contract. It primarily incentivizes LP positions from Fraxswap, Curve, Uniswap v2, etc.

Lending Gauge: This gauge encourages FRAX lending activity in money markets such as Aave, Fraxlend, Compound, etc. The deposit token is typically aFRAX, fFRAX, cFRAX, etc.

Uniswap V3 Gauge: This gauge accepts NFT LP positions as deposits. They are pre-configured to incentivize specific concentrated liquidity positions approved by governance.

Vault Gauge: This gauge accepts vault strategy tokens as deposits, such as those from Stake DAO or Yearn Finance.

Gauge Agnostic Pairs

The FRAX gauge system is flexible and supports any pool that integrates FRAX, provided it uses FRAX stablecoins and passes the gauge governance vote. This includes cross-chain pools. Thus, the veFXS gauge system is completely agnostic to the deposit token within a gauge as long as the FRAX stablecoin is being used within the strategy.

To sum up, the Frax gauge system provides a powerful mechanism for veFXS holders to directly influence the FXS emission rate and incentivize behaviors that strengthen the Frax ecosystem. By staking in gauges, users can maximize their yield while contributing to the stability and growth of the Frax protocol.

Fraxferry

Frax Ferry is a token-bridge service provided by the Frax ecosystem that allows for the secure and regulated transfer of tokens between different blockchain networks.

Why Frax Ferry?

Recent instances of bridge hacks due to bugs, malicious actions by teams, anonymous developers, and the risk of infinite token mints have highlighted the need for a safer bridging method. Furthermore, some chains have slow bridges, posing a bottleneck for cross-chain transactions. To address these issues, Frax Ferry was conceived.

Key Features and Benefits

Frax Ferry is designed to be slower, simpler, and more secure than other bridge services. The risks are capped by the token amounts in the bridge contracts, preventing the possibility of infinite token mints. The slower transaction process allows more time for any anomalous activity to be detected and halted. The Ferry also includes a feature where 'crewmembers' can pause contracts to investigate potential issues.

Partnerships

Curve and Frax are having very strong partnerships in multiple areas. The curve is honestly involved everywhere which is beneficial for both sides. The main LP for $FRAX is on Curve, and $sfrxETH is collateral for $crvUSD. Don’t want to stake the $frxETH, no worries just deposit it to the Curve LP with $CRV incentivizes.

I think it’s a great collaboration that can bring a lot of profit in the future for the users of both platforms, will see how it performs 🏄♂️

Conclusion

Frax is a remarkable and innovative platform in the DeFi space, introducing a unique approach to stablecoin issuance with its fractional-algorithmic method. This design aims to deliver the best of both worlds: the stability of fiat-collateralized stablecoins and the scalable efficiency of algorithmic stablecoins.

The ecosystem is robust, boasting several features and products that further enrich its offerings. The AMOs - Algorithmic Monetary Policy, for instance, presents a collection of smart contracts that act as revenue-generating agents for the protocol, reinforcing its stability and sustainability.

The Frax Shares (FXS) and veFXS governance tokens, on the other hand, offer holders not only a stake in the protocol's future but also a claim on the profits generated by AMOs. The $veFXS token, in particular, is a crucial component that aligns the interests of long-term users with the growth and sustainability of the protocol.

The FRAX-3CRV Metapool and the gauge weighted system stand out as ingenious features that incentivize certain behaviors advantageous to the protocol. This provides a significant level of control over the future FXS emission rate and incentivizes long-term engagement with the platform.

In conclusion, Frax's robust ecosystem, unique stablecoin model, innovative features, and commitment to safety and efficiency mark it as a significant player in the DeFi landscape. With the upcoming LSDFi Summer, we might see Frax rising to the numbers we couldn’t even imagine 👀

Links/Sources

Great Thread from Riley_gmi