Is Aevo the future of on-chain options?

Introduction

Aevo is a decentralized options exchange developed in partnership with Ribbon Finance. Aevo aims to provide a wide range of trading instruments for institutional and retail investors. By using a custom Ethereum Virtual Machine (EVM) roll-up, it offers improved scalability and performance.

Main features

EVM Roll-up

off-chain order book

on-chain settlements

Optimism Bridge deposits solution

fees system

margin framework

a collaboration with Ribbon Finance trading incentives

Background and Context

As the popularity of cryptocurrencies has surged, the demand for innovative financial instruments tailored to this emerging asset class has also increased. Both institutional and retail investors have taken a keen interest in the crypto market, exploring various investment opportunities.

The most commonly used financial instruments in the crypto space include:

Options

Perpetuals (PERPs) Futures

However, there is a huge difference between Options and Futures Platforms. If you want to trade options, you have only 1 platform with high enough liquidity: Deribit.

On the other hand, Futures are traded on all major CEXs with evenly distributed liquidity. We want to keep that in mind to better understand Aevo's competition.

Options always were one of the most favorite crypto trading instruments. The growth in crypto options trading over the last couple of years reflects evolving cryptocurrency market. The interest in ETH options reached ATH in sep '22, during the downtrend.

As the market expands, more traders are looking for advanced financial instruments such as options and structured products to hedge risks, speculate on price movements, and diversify their investment strategies.

Several factors are contributing to the rise in crypto options trading:

1. Instituiolan interest

2. CEX options adoption

3. Risk management alternative

Expansion of Defi trading platforms

With the evolution of Ethereum and the creation of L2 scaling solutions, trading platforms started to rise on-chain. Developing such a complex trading infrastructure is challenging but it has certain advantages.

Decentralisation: everything is built on-chain, which eliminates the need for intermediaries. Moreover, you have full control of your funds as they are managed by a smart contract you can always prove.

Permissionless access: there is no KYC/AML needed when you are using Defi. This allows greater accessibility to users worldwide, regardless of location. A huge benefit for US users.

Innovation: Defi platforms enable the creation of new, innovative products, that will never be implemented in traditional finance.

Seamless blockchain interactions: imagine Binance interacting with Deribit to offer some unique solution to the user, not likely and very complex. With Defi protocols, it can be done seamlessly, which enormously boosts collaborations between projects.

Lower fees: to attract users some of the Protocols may offer lower fees compared to CEXs. However, there are other expenses such as transaction fees, approvals, etc.

The most popular Defi Trading Solutions are dYdX, GMX, Gearbox, and Ribbon. dYdX and GMX have the highest TVL ($375.57m and $682.77m accordingly) and are both Perpetual trading platforms. The Gearbox offers composable leverage combined with the use of other Defi solutions such as Convex, Uniswap, etc. That's a seamless protocol interaction I was talking about.

Ribbon was also one of the first to introduce DeFi options. Those were packaged into "vaults", which led to the creation of DOV ("DeFi Option Vault"). The concept succeeded with >$10bn of options volume in the first year. We will look into the Ribbon x Aevo partnership a little bit later.

Despite huge success DOVs were too simple and inflexible for serious traders, that's how Aevo was created.

Aevo's Solution

Aevo being an on-chain trading platform has all those benefits I wrote about before. Furthermore, Aevo has some unique solutions to make the transition from CEX to DEX as seamless as possible.

High-Performance order-book

Aevo offers a robust trading platform with an order-book structure, allowing for better price discovery and tighter bid-ask spreads.

Margin system with Portfolio margin

Aevo’s portfolio margin provides lower margin requirements and increased leverage for traders who maintain a balanced portfolio of hedged positions. It is calculated based on a risk model which evaluates the margin based on the aggregated positions of the account instead of on the individual contract level.

More info here: Aevo Portfolio Margin - Google Docs EVM Roll-up

Aevo uses an EVM-based optimistic Ethereum roll-up called Aevo Rollup, which is operated in collaboration with Conduit.

Sequencer posts batch with transactions to Ethereum Mainnet hourly. Because of the optimistic solution the "dispute period" must be implemented. It takes 2 hours to fully confirm the transaction after the Mainnet batch was synched.

Off-chain Orderbooks and Risk Engine

Aevo uses an extremely smart solution to manage order books. The idea is that maker and taker orders are posted and matched off-chain, which leads to better performance, efficiency, and no fees for making an order

But if the order is not regulated by a smart contract, how do we know it's

still secure? That's why Risk Engine was created. The order can not be posted to the order book until it was not evaluated by an off-chain Risk Engine. Risk Engine checks different parameters (Balance and Margin) to make sure that the order is valid. Balance and Margin are being checked.

On-chain Settlement

That's where it gets interesting and is different from CEXs because the prev part realization is the same as all CEXes have tbh. The Aevo is making sure, that all funds and positions remain on-chain, within the smart contracts. It includes smart contracts, option settlements, funding payments, etc.

This kind of symbiosis lets us get the benefits of both CEX and DEX. The funds are safe in a smart contract, which you can always prove. Nevertheless, the creation of the order is faster, more robust, and involves no fees.

Ribbon Finance Partnership

Ribbon Finance is a Defi platform, which offers so-called DOVs (DeFi Option Vaults). They allow users to earn yield by selling options. The Vaults make the process easier and more accessible to retail investors by automating the process of selling options and managing the collateral.

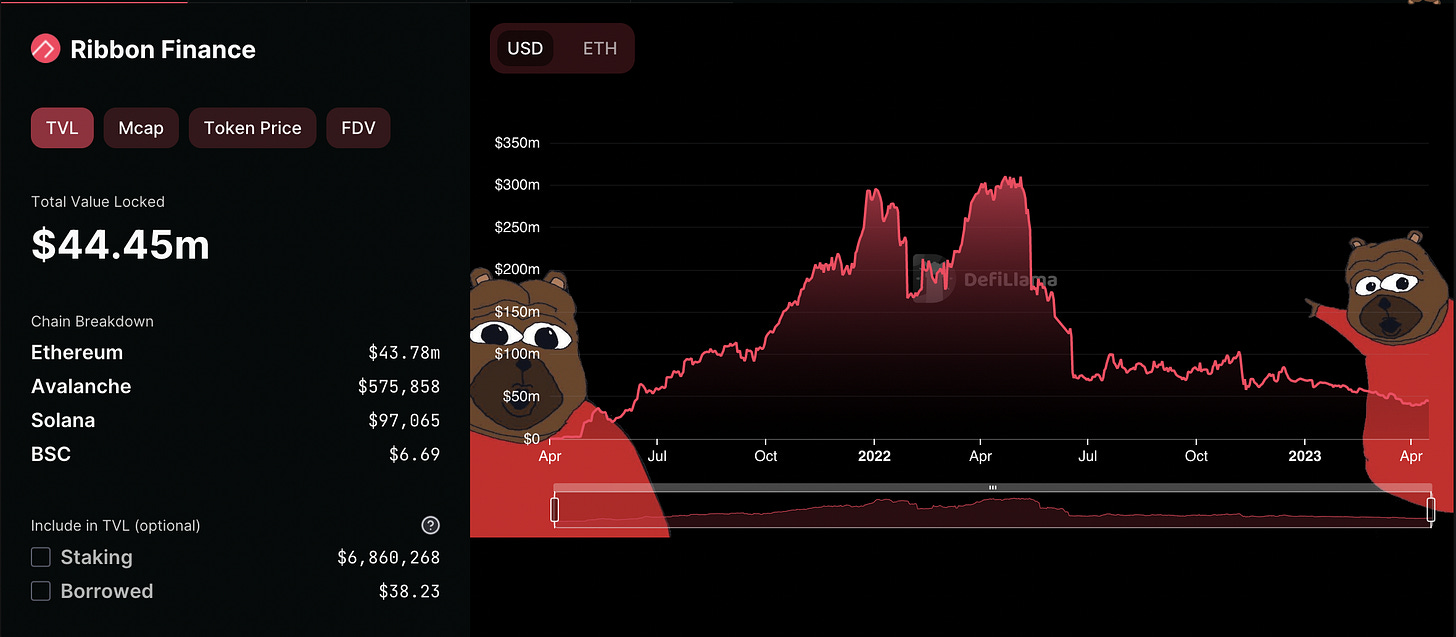

Ribbon has $44.5m TVL which is a relatively low value compared to other platforms but it's the biggest among option on-chain solutions. The Aevo is being developed in partnership with Ribbon Fiance.

Benefits

After the full launch, Aevo will be integrated with Ribbon. Aevo will serve as the venue where Ribbon Finance's options contracts settle. This will enable a seamless trading experience for the users of both platforms. This will enable consistent flow to Aevo(approx. $80m/week) and solve liquidity issues.

Ribbon users won't be locked with their funds from week to week. They will get access to exit their vault position at any time by using Aevo. Additionally, the Ribbon Auction participants will be able to use their oTokens as a real position on Aevo - getting margin to trade, hedge, take profit, etc.

When Aevo will get some traction in the future, it will make sense for other projects to build on top of Aevo to make their DOV more liquid. It would be possible to launch a DOV that sells weekly options or some other trading

strategy and use Aevo as an underlying venue for where these options contracts clear.

Trading and Margin Framework Fees

As expected there are taker and maker fees, 0.05% and 0.03% accordingly. If we compare them to Binance where both fees amount to 0.02%, we understand that innovations cost a little bit more. There are trading incentivizes from both sides, we will cover them a little bit later.

Another thing worth noting is that option fees can never be higher than 12.5% of the option price.

If an option is traded at $2 (ETH at $2k), the fee will be $0.25 instead of $0.6

An example of a transaction with fees on both sides.

Symbol: ETH-30DEC22-1500-C

Type: ETH Call Option

Underlying: ETH

Current Price: $1000

Strike Price: $1500

Quantity: 1 contracts

Expiration Date: December 30, 2022

Premium: 20 USDC

The user creates a limit sell order with a price of 20 USDC Maker Fees

min((0.03% 1 $1000), (0.125 * $20)) = min($0.45, $2.5) = $0.45 Taker Fees

min((0.05% 1 $1000), (0.125 * $20)) = min($0.75, $2.5) = $0.75 Settlement Fees

When options expire in the money, there is an exchange of cash between buyers of the option and sellers of the option. Aevo charges

a 0.015% settlement fee on the notional of the option that expired in the money. This fee is charged to the holders of the option at expiry.

Settlement fees can never be higher than 12.5% of the option's value. Settlement fees are also not charged for Daily Options.

An example of a transaction with fees on both sides.

Symbol: ETH-30DEC22-1500-C

Type: ETH Call Option

Underlying: ETH

Current Price: $2000

Strike Price: $1500

Quantity: 1 contracts

Expiration Date: December 30, 2022

User A holds 1 contract of ETH-30DEC22-1500-C, which is in-the-money at expiry.

Settlement Fees paid by User A:

min((0.015 1 2000), (0.125 * ($2000-$1500)) = min($0.3, $62.5) = $0.3

Liquidation Fees

When the options position gets liquidated, a liquidation fee is charged. Liq fee amounts to 0.2% of the option notional

If the option with the current price of $4000 got liquidated, the fee would be $8

User Onboarding

As of 17.04.2023, the Aevo has $2.24m TVL. One of the main problems of launching projects is to get liquidity, which comes with users. Aevo launched an incentivized program to stimulate the trader's transition.

Everyone who trades at least 10 ETH options contracts of any instrument will get a 1% bonus to their deposit. At least $1000 USDC must be deposited to be eligible. The max rewards are capped at $500 per user, which results in $0.5m of deposited funds.

Furthermore, the Ribbon users who were participants of Ribbon Lend and are in the snapshot will get Exchange Pass NFT and $50 USDC in trading credits.

Comparison with Competing Platforms

Now we came to the most interesting part of the research - competition. The most difficult part of launching any platform is users. Let's dive into Aevo's competition and see if it has a chance to get its piece of the Options Trading pie.

Competitors

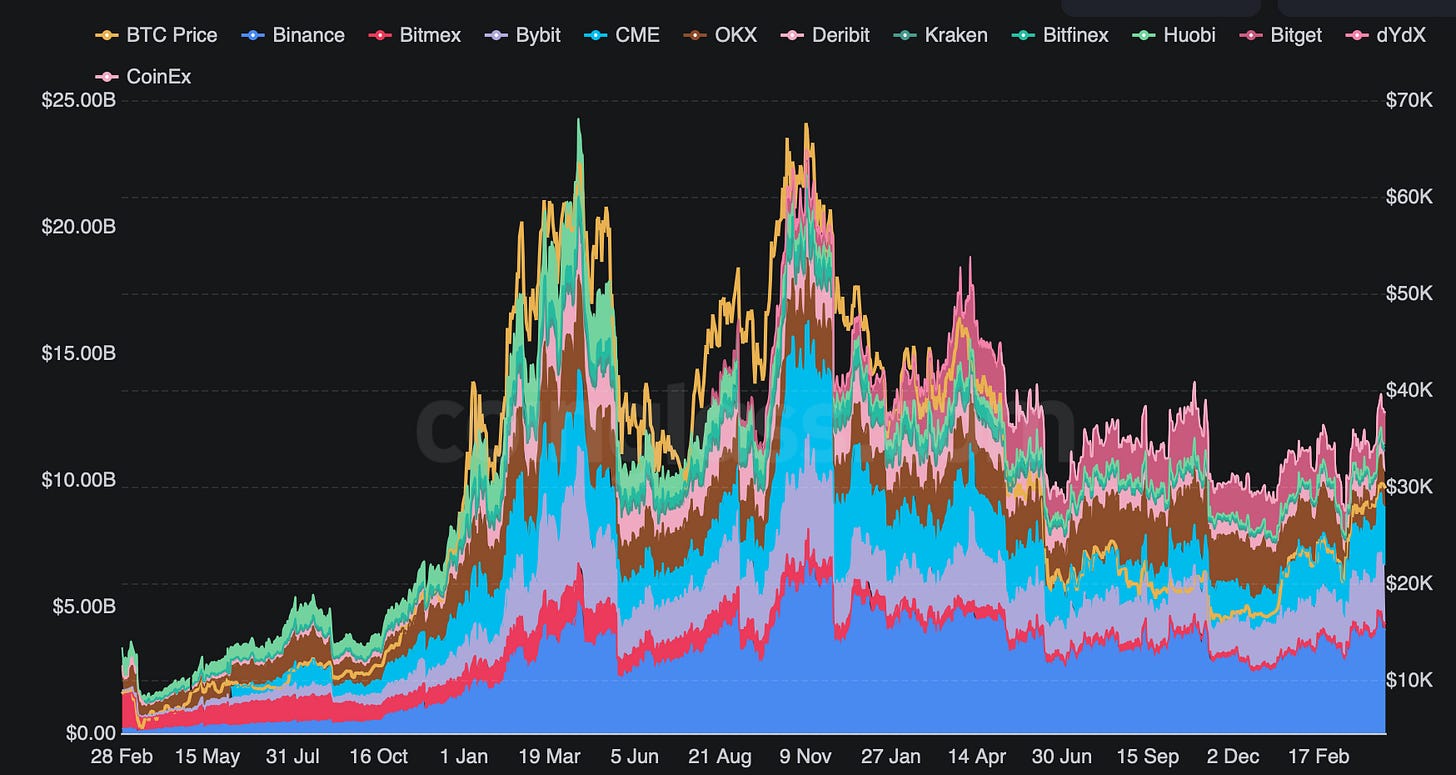

As I mentioned earlier Deribit dominates with a market share of 79.7%. It's a huge monopoly there and Aevo aims to break it.

CME, Binance, and OKX are also offering options tradings but their market share is fairly low (20.3% combined).

Trend

If we pay just a little attention we can spot the correlation between the BTC Spot price and the BTC Options Open Interest. The Open Interest follows the Spot price until Jan '23 and then it's showing much quicker growth.

We can see that compared to BTC Futures Open Interest, we came back to ATH much faster. Looks like the investors are preferring Options over Futures and already using them on the same level as during the recent bull market.

Now we understand that Aevo did a great choice in choosing a type of financial instrument to offer. Options are widely used, fast-growing, and have great adoption among institutional investors. The question is: "What problems can Aevo solve to attract users?".

Problems

Despite the ETH and BTC being so-called WEB3, all Options trading platforms are coming directly from centralized WEB2. As I already mentioned previously all CEXs are losing the advantages of on-chain platforms.

You need to identify yourself. KYC is mandatory which cuts a part of the users off. With WEB3 you can stay anonym and still have platform access.

You need to give up ownership over your funds. This exposes a risk associated with the exchange's security measures.

Absence of transparency using CEXs. They can not offer transparency and audibility of all transactions like Aevo does.

Lack of integrations with other protocols. Deribit will never partner with Binance to offer some user benefits, which is very common in the WEB3 world.

Wait what about other DeFi Platforms?

Indeed there could be some competition for Aevo. Platforms like Opium, Dopex, and Opyn are offering some kind of Options Instruments.

To be honest they are not even close and have some major disadvantages:

They all use some kind of pool (DOVs) and it's unfamiliar to the users. Aevo offers an understandable, simple order book. That's a way to onboard users from WEB2 platforms. Pools are too inflexible, as Ribbon Finance already mentioned.

UI/UX is way worse and less robust than Aevo's. You are getting a familiar CEX kind of experience on the on-chain platform, the perfect combination.

Now imagine you are opening Opium and seeing this as an institutional investor. I would close it and never leave Deribit ever again.

Opyn looks better but again offers just some kind of USDC staking and "Squeeth" instrument, you can read more here if you want

SSOV also offers only DOVs and has way less TVL than Ribbon

3. The Aevo is just built differently. None of the competitors have EVM Roll- ups to enhance the speed and lower fees or off-chain order books because no one offers this kind of instrument in DeFi yet.

Summary

After a deep dive into Options Trading instruments both on-chain and centralized we do see a decent piece of market aevo can take. I have not found any DeFi Platform with this level of UI/UX and such strong backers as Ribbon. Aevo just combines the best of 2 worlds, so both web2 and web3 users will feel familiar with the platform.

The biggest problem to solve will be users. It's hard to attract institutional customers from Deribit if your ETH OI is ~2000 times lower. We still need to keep in mind, that Aevo is just starting, and not everyone even has access so obviously the situation will get better after a complete launch. Ribbon Finance support will also add money flow to the Aevo, from which both will benefit.

With the growth of a variety of Options and the onboarding of new customers, Aevo will have decent growth shortly. If the market conditions will be right, the adoption might skyrocket. "Not your keys, not your coins", I believe Aevo can profit from those narratives as well.

Regulatory and Security Considerations

With Aevo being decentralized the regulation won't be a problem but we might consider looking into some security issues.

Smart Contracts: Since Aevo is built on smart contracts, the security of the underlying code is crucial. This repo is supposed to contain Aevos audits but as for now, I found only Ribbon ones. I assume the code base is being audited and until the full launch, the audits will be done.

Custody and Asset Security: Aevo being a non-custodial platform, users maintain control over their assets at all times. This reduces the risk of hacks or other security issues associated with centralized exchanges. However, users should still take necessary precautions to secure their own wallets and private keys to prevent unauthorized access. With the integration of ERC-4337, this won't be an issue anymore. The onboarding and UX will improve further.

Potential for Sybil Attacks or Front-Running: Decentralized exchanges can be vulnerable to attacks like Sybil attacks or front-running, where malicious actors exploit the open nature of the platform to manipulate trades. I have not found any information about any specific actions being taken but I am sure with the finalized audits the platform will be secure to use.

Conclusion

In conclusion, Aevo represents a promising next-generation options exchange that aims to address the needs of sophisticated options traders in the rapidly growing cryptocurrency market. By offering a comprehensive suite of financial instruments, aiming to provide deep liquidity, and providing instant onboarding with USDC deposits from the ETH chain, Aevo has positioned itself as a strong contender in the decentralized finance space.

The integration with Ribbon Finance further highlights the potential for innovative solutions and synergies between the two platforms, creating a robust ecosystem for both passive and active options traders. As Aevo continues to develop its offerings and explore collaboration opportunities with other DeFi projects, it has the potential to become a leading venue for on-chain options trading.

However, Aevo must remain vigilant in addressing regulatory and security concerns, ensuring the platform's long-term sustainability and credibility in the market. By focusing on scalability, cross-chain capabilities, and regulatory compliance, Aevo can stay ahead of the curve and capitalize on the growing interest in crypto options trading from both institutional and retail investors.