Introduction

Hi, dear member of the Racing Crypto Club 🤝

In this research, we will dive into all possible LSD providers and DeFi LSD solutions built on top of them and will find the best earning opportunities out there. I will distinguish them on different risk levels. Even if not always high risk = high reward, in this case, I would adjust the strategies accordingly.

Before starting let me explain the meaning of LSD. LSD (Liquid Staking Derivative) is representing a staked asset ($ETH in our case) in a POS blockchain. The main difference between direct staking is liquidity. The holders are still receiving rewards but can freely do all common DeFi activities (swap, lend, etc.).

I am very excited about this massive research I have done here and hope that everyone will find something profitable here. I will not dive too much into the specific details of each project here because that’s not the purpose of the research and very few crypto users actually willing to read it.

If you liked this article, feel free to share it, so more people could discover LSDs.

LSD Providers

Lido

Let’s start with the biggest TVL DApp and LSD Provider respectively - Lido. According to DeFiLlama, Lido is sitting at almost 7m of staked $ETH with a market share of 73.65%.

Lido is a no-brainer choice for those who don’t want to research too much and just want to go with the biggest one. Lido has a pretty average APR (compared to others) including the 10% protocol fee.

Lido offers 2 LSD tokens $stETH and $wstETH. The main difference is that $stETH is a “rebase token”, which means that your wallet balance just grows every day. On the other hand, $wstETH is a “reward bearing” so the balance is not actually changing but its price is appreciating to the $ETH itself.

$stETH is an easy solution as you are literally getting more $ETH just by holding but it gets complicated when you want to use it in Defi, as you will stop getting rewards once you transferred it. Paying taxes can also be an issue since increasing in token amount might be counted as income, not profit.

$wstETH is a more convenient option for DeFi users as you're getting rewards as you just own it, doesn’t matter if it’s in your wallet or some contract. The yield is still the same 🐳

Rocket Pool

Moving to Rocket Pool, the 2nd biggest LSD provider with over 667k $ETH staked. Rocket Pool offers here 2 options for its users. Either you can go the Lido way and just buy the $rETH (similar to $wstETH) and get your yield just by owning. Or you can choose another a little bit more complex way of Staking + Running a Node.

This results in a much higher APR, compared to just buying $rETH (6.9% to 3.94%), and allows users to get a $RPL Reward. $RPL is a native token of Rocket Pool and is used as incentivize for the node operators for high uptime and discourages incurring penalties. Node operators can also stake $RPL to receive a higher share of the protocol commissions

Besides, $rETH is much more user-friendly and requires no node running, here you can see the price appreciation of $rETH to $ETH.

Frax Finance

Frax Finance is the ultimate multitool of crypto. Almost all possible DeFi instruments are present there, including LSDs. Every protocol is a little bit different in its approach to LSDs, and Frax is not an exception.

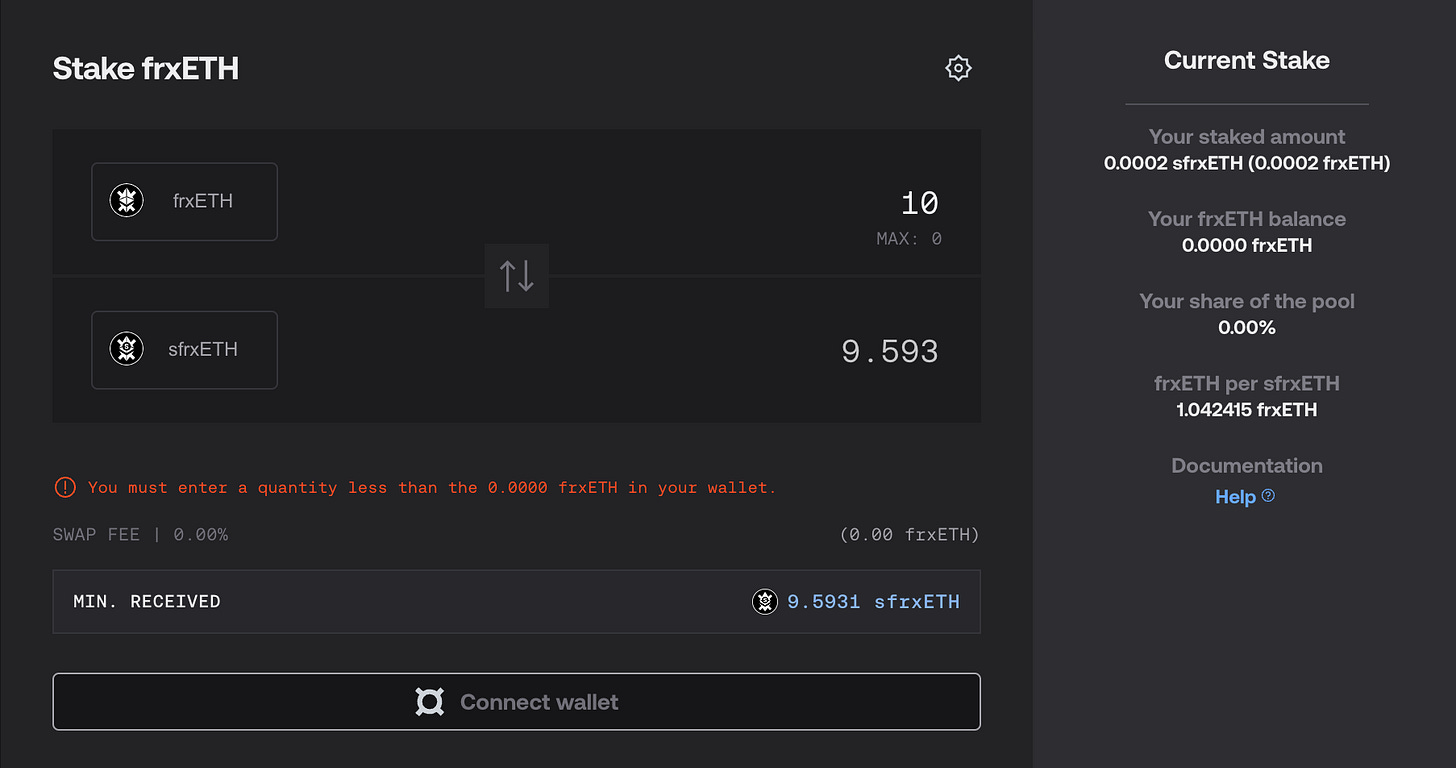

Frax LSD Ecosystem consists of 2 tokens, $frxETH, and $sfrxETH. $frxETH can be minted 1:1 to the $ETH and has no rewards itself as the $stETH for example. If you want to get the yield you need to stake it for $sfrxETH. $sfrxETH is actually very similar to $rETH and $wstETH as it also increases in price with time to $ETH.

Over time, as validators accrue staking yield, an equivalent amount of $frxETH is minted and added to the vault, allowing users to redeem their $sfrxETH for a greater amount of $frxETH than they deposited, a kind of auto compounding.

Another profitable opportunity is Curve $frxETH/$ETH Pool with a similar APR to staking it, which is possible via $CRV rewards

Stake Wise

Stake Wise doesn’t have as many features as previous platforms and offers a very similar LSD staking service. Every deposited $ETH gets tokenized into the $sETH2 and the holders of this token are getting the staking pool rewards.

Rewards and penalties generated by the Pool are distributed among stakers pro-rata according to their share of the Pool, reflected in sETH2 (staking ETH) and rETH2 (reward ETH) minted to stakers in a 1:1 ratio. The platform charges a 10% commission on the Pool's generated rewards to cover the costs of infrastructure and development.

Unfortunately, StakeWise Solo Pool is no longer open to new deposits, but it previously allowed users to deposit in batches of 32 ETH and run their own validator using StakeWise's infrastructure. Existing users of this product will still benefit from all infrastructure upgrades and retain complete access to their validator balances through the withdrawal of key ownership. StakeWise has a market share of ~1%.

CEX LSDs (Binance, Coinbase)

The last type of LSD provider is centralized exchanges such as Binance, Coinbase, and Kraken previously. Those are very simple and convenient solutions with funds ownership tradeoffs.

Coinbase is actually being the most popular CEX provider rn with a whopping 1.134m of $ETH staked, it’s more than Frax and RocketPool combined. Binance has a much lower share of 70k $ETH. These LSDs can also be used in different DeFi protocols such as $cbETH for Coinbase and $bETH for Binance.

The only drawback is that those are issued by centralized Exchanges which vastly reduces decentralization and your ownership over the funds.

Exploring the DeFi Opportunities

In this part, we will explore different DeFi Projects, which are built on top of DeFi. We will cover everything from interest-bearing stablecoins to getting our yield upfront and after that, we would explore the most profitable DeFi strategies.

We will be using an awesome Dashboard made by Mochi 🍡 to analyze all of the following DApps, make sure to give her a follow 🫡

Lybra Finance

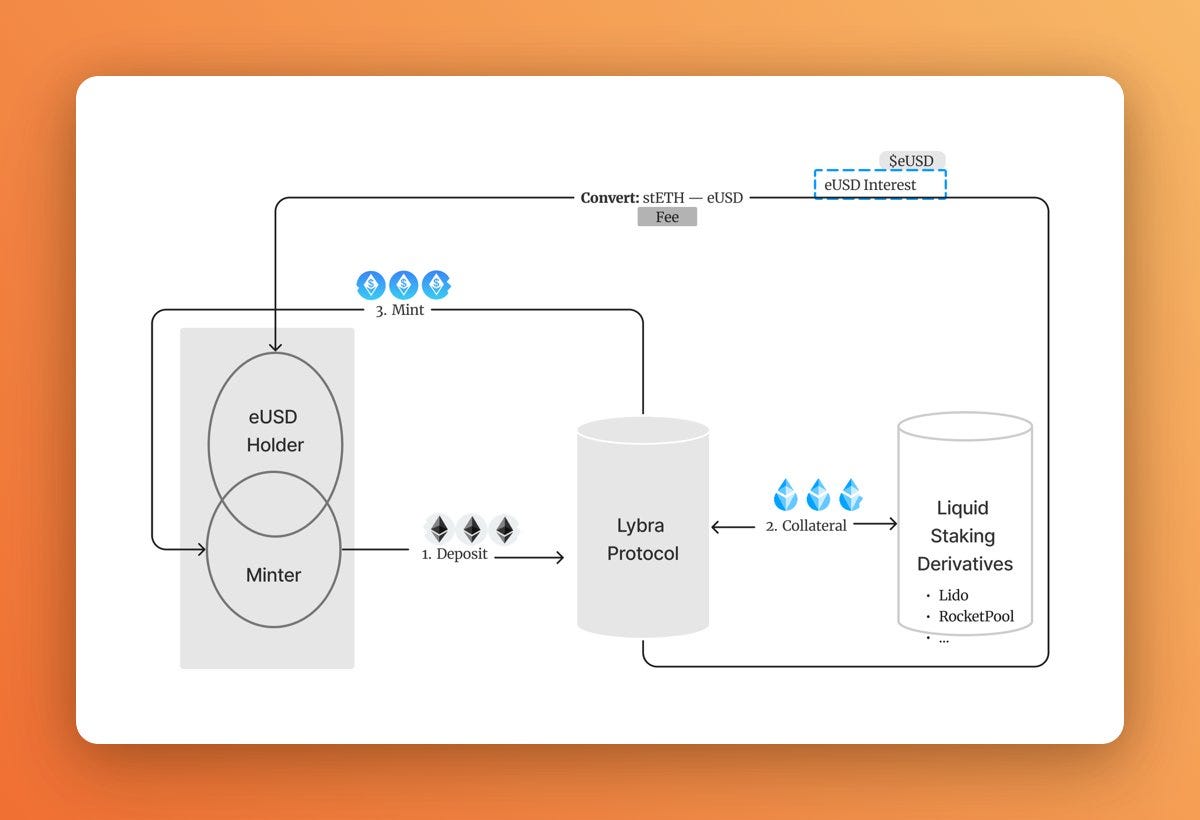

Lybra Finance is a newcomer in the LSD space but already has huge success with a TVL nearing $200m. We all have heard of its unique interest-bearing stablecoin $eUSD. This mechanism is indeed very unique, which allows the $eUSD holders to get 7.2% APY in real-time.

The main idea behind Lybra Finance is to give you a stable coin that will multiply in your wallet just by holding it. To mint the $eUSD you need to deposit the $ETH/$stETH which then will be converted to $stETH to generate yield and distribute it between the holders of $eUSD.

In other words, you are just getting the yield of your deposited $stETH with an even higher APY (~8.2%) which might sound crazy but has a very simple explanation. Each $eUSD is backed by at least 1.5$ of $ETH. As a result, the mcap of $eUSD will always be lower than the mcap of deposited $stETH, which leads to rewards being distributed across lower mcap with higher APY per coin, magic

Lybra Finance is governed by Lybra DAO, which is built over $LBR token. It's designed to have multiple purposes:

Governing the Lybra Finance

Boosting Yield

Incentivizing the eUSD minting

Distributing the protocol revenue

$LBR is being used to incentivize the minting of $eUSD and to govern the protocol. The protocol revenue is also being distributed across $esLBR holders, vested $LBR.

As of 31’ May Lybra almost has half of all Protocols built on top of LSD solutions.

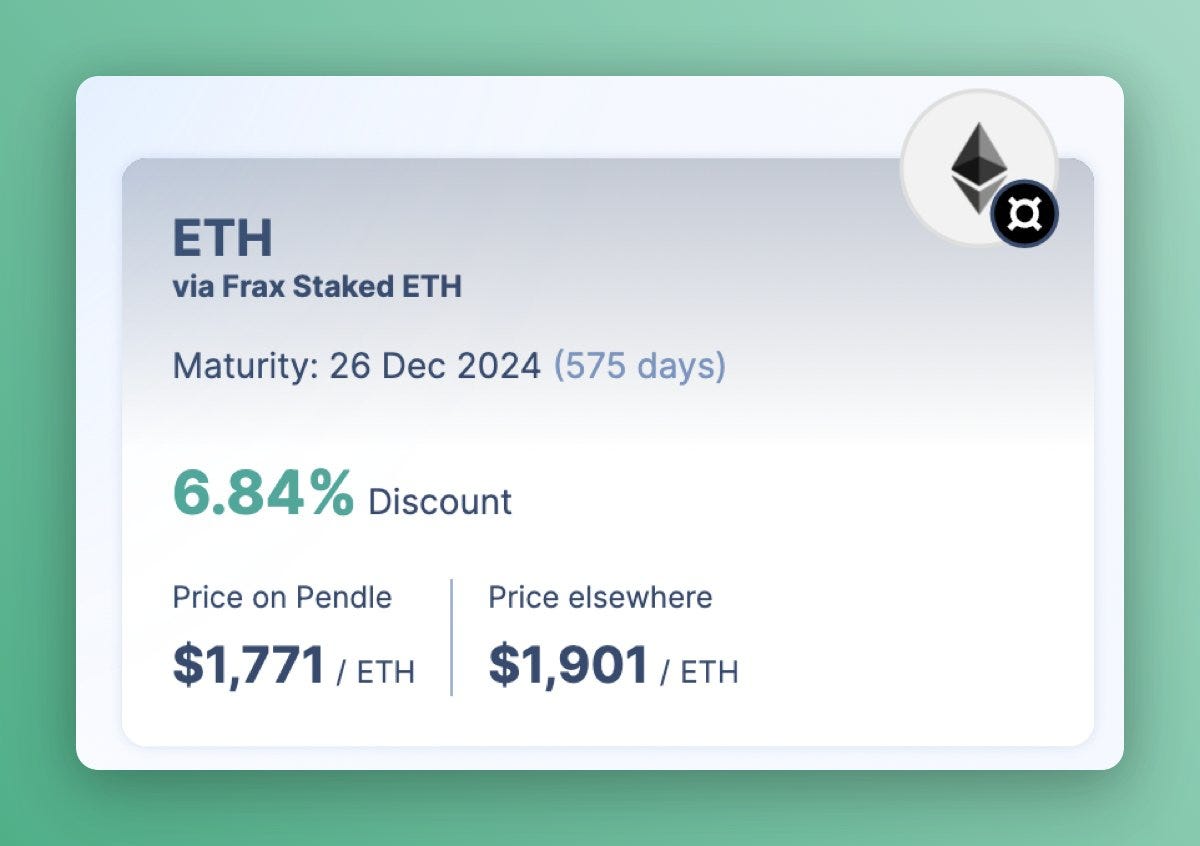

Pendle

Now let's move to the next candidate - Pendle. This protocol does something very unique to allow users to buy an asset and its yield separately. So-called PT (Principal Token) and YT (Yield Token) are used for an asset and yield respectively. PT + YT always equals an underlying asset. They have just reached $80m and rapidly moving to $100m.

The main idea behind the Pendle is to give users much more flexibility in working with yield assets. Here is an example: You can get a discount on the $ETH by buying an asset without a yield on it (so-called principle token PT)

Moreover, you can buy a yield on the asset if you think that it might get higher. During the recent meme-coin season, a high amount of transactions resulted in higher validator rewards -> higher yield on $ETH. Buying the yield token (YT) would result in massive gains 💸

Compared to Lybra Pendle doesn’t have a high TVL of LSDs because it also operates with other yield assets like $USDT, $sAPE etc. Nevertheless, Pendle offers great opportunities for LSD holders, about we will talk about soon.

Instadapp

Instadapp is a decentralized finance (DeFi) smart wallet designed to provide users with a simplified interface for interacting with a range of DeFi protocols. It acts as a single point of integration that supports numerous DeFi platforms, including MakerDAO, Compound, Aave, Uniswap, and others.

It offers a one-click staking solution for staking LSDs with a very tasty APR of 6.80% and has a massive piece of 16.365% according to do Mochis dashboard.

Unsheth

The Protocol was hacked, don’t deposit anything and withdraw all funds ASAP. Never trust Certik LMAO

UnshETH is on a mission to increase the decentralization of $ETH through incentivization, distributing capital across the liquid staking derivatives (LSDs) like:

UnshETH aims to provide a diversified liquid-staked $ETH basket that earns $ETH yield and swap fees. Everything is packaged in a single ERC-20 token - $unshETH. Users can mint unshETH by depositing a supported LST, and can redeem $unshETH into the basket of underlying LSDs. As the underlying LST(Liquid staking token) is accruing yield, $unshETH accrues value

$unshETH is a liquidity hub for LSDs, allowing users to swap between LSDs up to their maximum weight. This also allows for reducing the slippage and swap fees between different LSDs.

UnshETH has also a governance token called $USH. USH is an incentive layer for $unshETH. It is used to grow $unshETH TVL and liquidity and to foster competition among liquid staking protocols. Staked USH (vdUSH) governs the following:

$unshETH protocol composition (inclusion/exclusion of LSDs, target weight, and maximum weight)

How to direct USH incentives and partner protocol incentives

Fee curve parameters and fee switch

Asymetrix

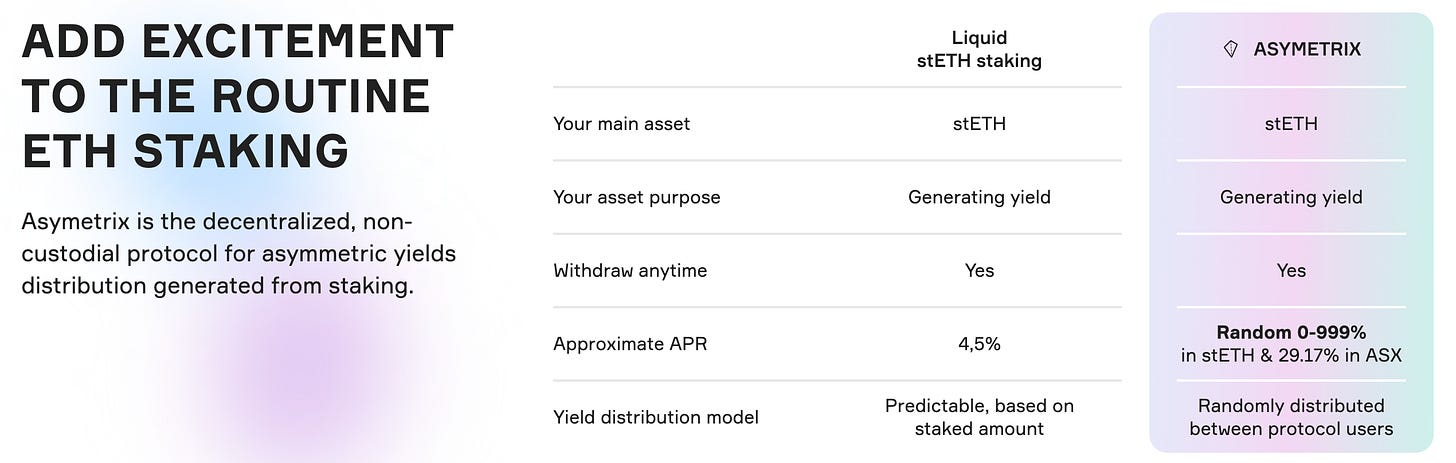

Asymetrix is a decentralized, non-custodial protocol designed for asymmetric yield distribution generated from staking.

The pool generates a yield every 24 hours, which is periodically distributed among pool participants in a random and asymmetrical manner. It's like a lottery, you can double the deposit or just get no rewards at all.

Asymetrix aims to make Ethereum staking more exciting and attractive, particularly for smaller holders. Traditional Ethereum staking can potentially not be that rewarding for those holding smaller amounts of ETH due to the relatively low yield.

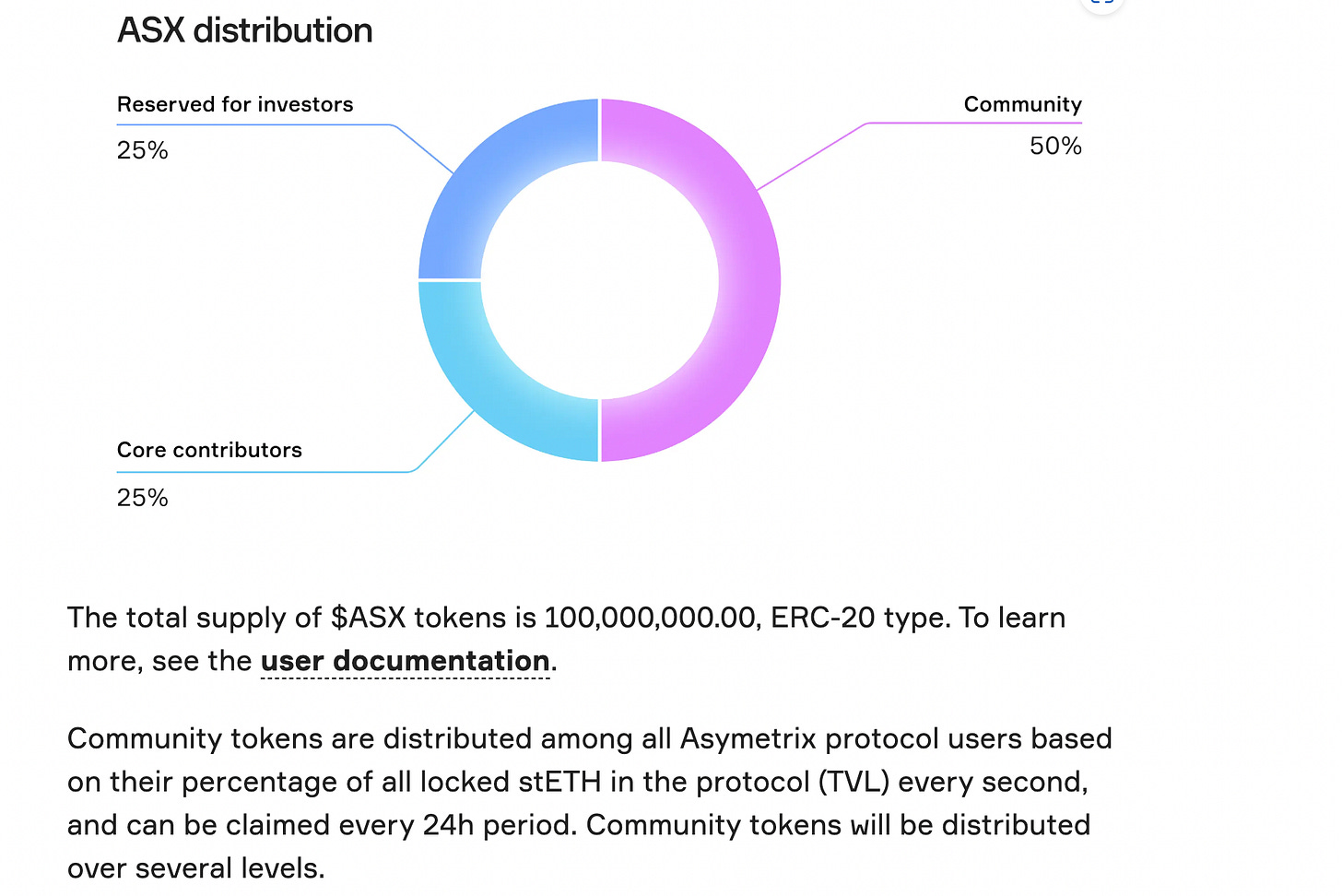

The Protocol has also a governance token $ASX. It’s being distributed across all the participants of Asymetrix and can be claimed every 24h period.

Alchemix

Alchemix is a decentralized platform that allows users to obtain advances on their future yield. Users deposit assets that earn yield in other DeFi protocols, and these yield-earning assets are then used as collateral to mint the protocol's synthetic stablecoin, $alUSD.

This minting process creates a loan that is automatically paid back over time using the yield generated by the deposited assets. This self-repaying nature of the loans is exactly what makes Alchemix unique.

In Alchemix V2, users can choose to deposit assets into different "vaults" depending on the type of yield-bearing asset they hold. Currently, Alchemix V2 supports DAI, ETH, and BTC vaults. Users deposit their assets in these vaults, which are then put to work in different yield farming strategies. The yield generated from these strategies is used to pay back the alUSD loan over time.

The TVL of Alchemix grows steadily and sits currently at $13.88m 🐳

Curve

Now we came to $crvUSD, an over-collateralized stablecoin with several unique features that set it apart from its contemporaries. Over-collateralization means that users are required to deposit more collateral than the value of the stablecoin being minted, a design choice that helps to maintain stability and reduces the risk of volatility.

crvUSD is designed as a solution to the chronic price volatility experienced by many cryptocurrencies, serving as a stable store of value in a market known for its fluctuations. It is designed to be pegged 1:1 with the US dollar. Its design allows it to maintain a constant value irrespective of market conditions, thereby providing a reliable transactional currency for users.

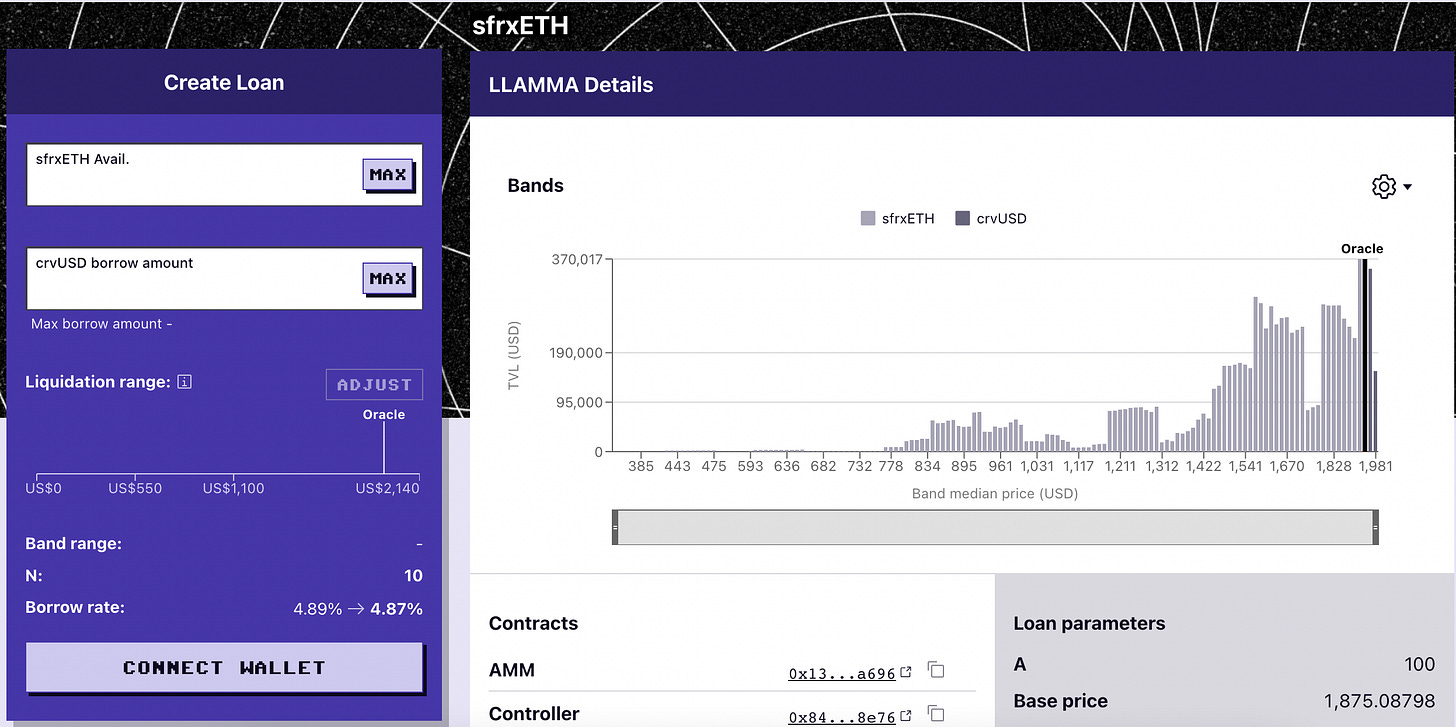

Curve's approach to liquidation is another feature that distinguishes $crvUSD. Rather than relying on external DEXs for liquidation, Curve utilizes the LLAMMA (Lending-Liquidating AMM Algorithm) Pool. This pool aims to reduce users' losses as much as possible when liquidation occurs, gradually liquidating users' collateral and converting it back when the price rebounds.

The design of the LLAMMA Pool helps maintain crvUSD's stability. The pool contains collateral and crvUSD, and when the price of the collateral falls below a certain point, the collateral in the pool will gradually convert into crvUSD. If the price of the collateral rises above a certain point, the crvUSD in the pool will convert back into the collateral. This innovative feature allows for a more seamless and less disruptive liquidation process, keeping the value of crvUSD stable.

Right now the only collateral which is available now is $sfrxETH from Frax (u might not know but Frax and Curve have a very strong partnership). It lets us to still get the yield on staked Yield and grab some stables. The $crvUSD is only in beta, so I was told that the Borrow rate will fall. Sounds tasty 🍕

Gravita

Unlike many protocols that offer a variable borrowing APR dictated by the unpredictable whims of supply and demand, Gravita provides its users with an interest-free borrowing experience, subject to a modest maximum one-time fee of 0.5% for positions held longer than six months. This model eliminates the constant monitoring anxiety associated with sudden APR hikes, thus making borrowing more approachable and less stressful for users.

Additionally, Gravita Protocol introduces an exciting feature to promote short-term borrowing: a pro-rata fee refund mechanism. Should a borrower repay their debt before six months, they receive a refund on the 0.5% borrowing fee, relative to the time elapsed (with a minimum of one week's interest). Controlled by smart contracts, this refund system secures immediate remittance of the minimum fee and maintains comprehensive records, ensuring transparency and convenience.

In an effort to provide stability and reduce volatility, Gravita is also introducing a Liquidity-like redemption mechanism, enabling redemptions at a rate of 0.97 to 1. This means that redeemers pay a 3% fee to the borrower. This, along with the earning opportunities provided by the accrual of LSTs against ETH as collateral, ensures that users can have a significant advantage and lower risks of liquidation or redemption.

Moreover, the Gravita Protocol includes a novel System Status feature. Based on the current system Loan-to-Value (LTV) ratio, it displays the system's status ranging from 'Normal', 'Caution', to 'Recovery Mode'. This ensures that borrowers are well-informed about the health of the system, thereby prompting timely action. A unique aspect of this feature is that each collateral type has an independent System Status, allowing specific collateral types to enter Recovery Mode, while others may not.

The idea sounds very interesting as we can get the borrowing almost interest-free if we will repay the loan in the certain period, might a smart play.

Flashtake

Flashtake (FSP), is a pioneering innovation in the DeFi space that enables a sort of financial "time travel".

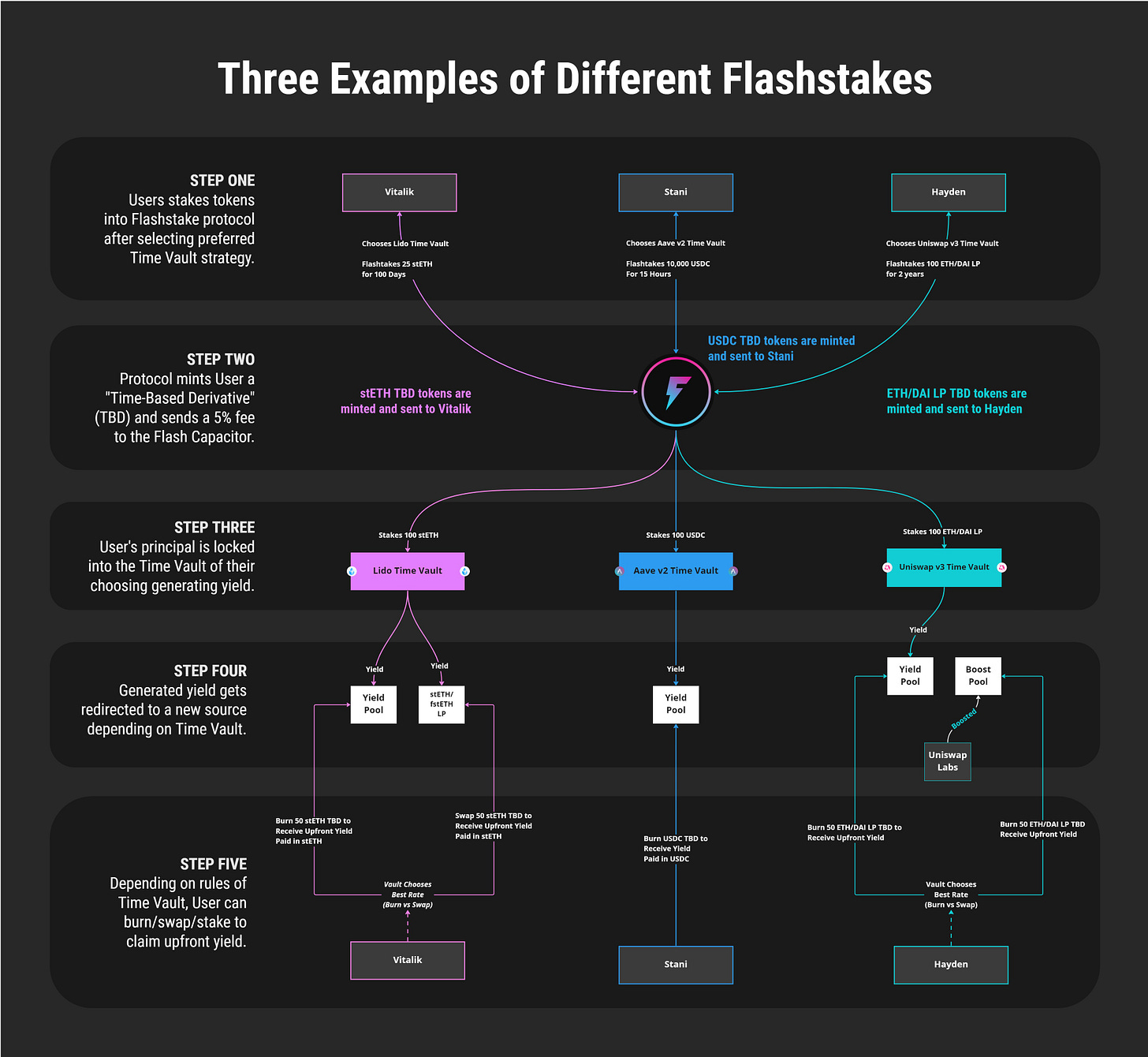

One of the key aspects of Flashtake is the concept of Time Vaults Pools, which are the source of upfront yield in a Flashstake. There are three primary types of pools: Yield Pools, Liquidity Pools, and Boost Pools. The Yield Pool generates yield from its source (like Aave or Lido) and redirects it into the pool. The Liquidity Pool allows individuals to add liquidity to TBD tokens. And finally, the Boost Pool lets anyone deposit money directly into it, subsidizing the cost to jumpstart a Time Vault.

Another key component of Flashtake is Time-Based Derivatives (TBDs). These represent the time value of money for any digital asset. When individuals stake into a Time Vault Strategy, Time-Based Tokens are minted, each one associated uniquely with a particular Time Vault Strategy. For example, staking USDC into the Aave v2 Time Vault Strategy would mint the fUSDC TBD.

Furthermore, Flashtake introduces a feature called Flashstake, which lets users mint and redeem yield in a single transaction. This function stakes its principal into a strategy, mints TBDs, and then uses these TBDs to get an upfront yield. This one transaction encompasses all these activities.

Flash take is currently sitting on $7.77m of TVL with 2% of the market share. I really like the idea of getting the yield upfront if you are worried that it will fall in the future for example. So you can basically fix the yield and get it upfront (with the asset itself locked in Flashtake).

Comparing the DeFi Opportunities

To find the best LSD earn opportunities we will be using awesome Dune Dashboard from Defi_Mochi, make sure to follow here if not done already.

The strategies I found always consists from the LSD Provider + LSD Platform, let’s see what have I found:

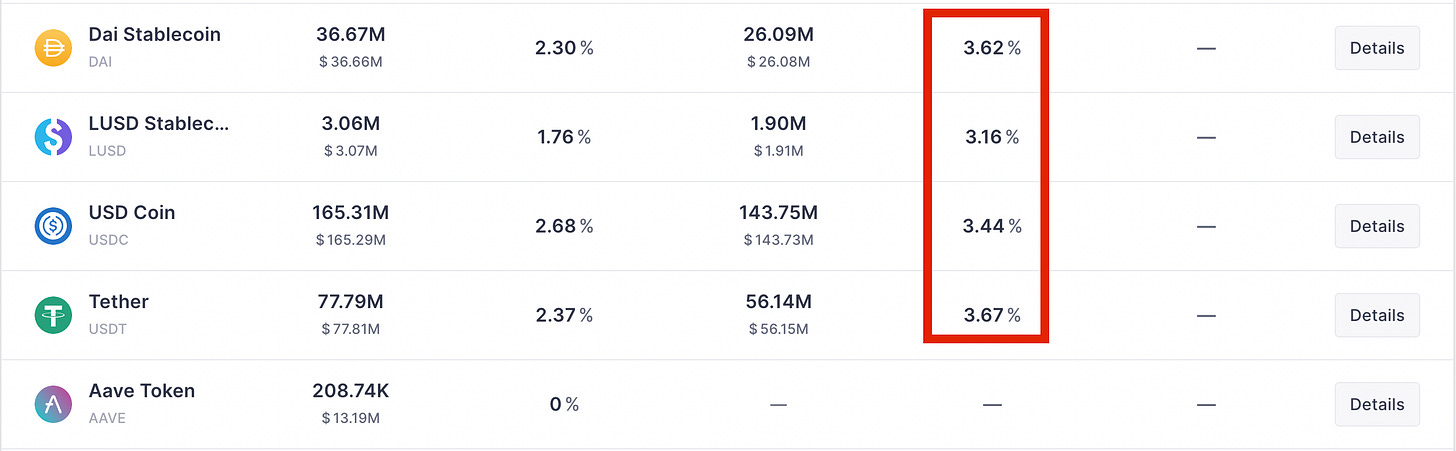

1. Lybra USD Swap

Basically what Lybra is doing is that they are just taking yield the yield from deposited $ETH and give you this yield back on your $eUSD with their commission. If we belive that $eUSD is balanced enough (won’t crash). The mechanism is built the way, that you can always redeem 1$ of $ETH from 1 $eUSD, so if the price drops below 1$ for whatever reason, the people will just buy it and redeem 1$ worth of $ETH. So the idea would be to just swap a portion of your USDC/USDT for eUSD and get some yield on them. The only risk is a smart contract risk of $eUSD, otherwise everything looks pretty simple.

Another option would be to add some liquidity to $eUSD/USDC LP Pair to get even more APR, rn around 17.55%, which is very sweet for the stablecoins. RN the liquidity is available on Curve.

2. $crvUSD + $sfrxETH = 🫶

This strategy allows us to still get Yiled but to get some stablecoins to play around with. The partnership of Frax and Curve was always very strong but now with the $crvUSD in beta as the first collateral $sfrxETH was chosen.

You might say that this strategy has no sense because we are paying for borrowing basically the same APY as we are getting from our $sfrxETH. Not exactly correct as $crvUSD is still in Beta, which means that the Borrowing rates will drop to the normal market levels.

If we will take a look at he Aave rates, I think $crvUSD will sit on the same levels after the official launch. Moreover we are getting LSD Yield on the whole amount of $sfrxETH but paying borrowing yield only on a certain part of it (a half for example).

I really like this smooth liquidation process announced in $crvUSD which try to liquidate you as “cheap” as possible and will even rebuy back if the price is getting back and you are no more in the liquidation zone. During the bull market biggest part of stables (for me personally) will be converted in $ETH and to get some spare stables for some plays it would be one of the best opportunities.

3. Pendle Yield longing / Yield fixing

Pendle offers something very special for real degens (if you are reading it, you are for sure 🤝 ). We can play with the LSD Yields or even fix them if they are sweet enough.

Before diving into it want to underline one more time that PT (asset without yield) + YT (the yield of the asset) = 1 asset itself

So basically if yield (YT) is priced too high as it was during the meme-season around 10th-12th May the asset itself (PT) is priced lower. So if we could somehow predict the future of the meme-season we could just buy the $ETH yield and get some huge profits (almost 50% in 12 days).

As of 1’ June the yield is back to normal levels, which makes PT a little bit overpriced rn. Pendle calculator helps us to compare both. If we would just hold the $stETH with the current APY of %4.846 we would earn more.

It’s always good to buy YT when the PT is overpriced and inversed. So it would be great if someone has fixed an awesome yield on $ETH on 12th May when the PT token was undervalued. You can redeem the underlying asset 1 : 1 to the PT when the maturity comes, that’s how you know they your yield is fixed.

If you don’t really want to play too much with PT and YT just add some liquidity to the LPs and boos them by locking your $PENDLE, some insane APY availabe there and can be almost doubled with $vePENDLE.

Really like what Pendle is building and what is being developed 🫶

PEEEENDLEEEE

4.Degening with Asymetrix

The last strategy would be for the low-banks who like gambling ( all people who sent money to BEN.eth, lmao who are they?). Asymetrix randomly distributes the Yield across the stakers so if you stake $1000 for example either you are not getting ~$50 a year from yield or you can multiply your money.

All the pool participants are also getting $ASX but if everyone gets it, IDK how they price wouldn’t dip. Overall you still own your $ETH and just gambling a YIELD, sound fair to me, especially for low-banks.

Conclusion

I didn’t mention a lot of other Protocols like Flashtake, Alchemix or Gravita but I don’t really see any super opportunities there. Yes, you can get your yield upfront by locking the asset itself but he APR is not looking that good and to get any reasonable amount you need to stake 50-100 $ETH, otherwise the gas fees might even cost more.

Gravita looks interesting with it’s zero fees loans but we need to see how sustainable it is and the TVL is still around $11m which is a lot but still not enough to make me use it.

If you have any strategies yourself lmk and we will add them to this newsletter, would be very happy to discuss with y’all. Thanks a lot for reading, subscribe, share with friends and see you next time, racer 🏎