Introduction

In the dynamic and often unpredictable world of cryptocurrencies, it is always crucial to navigate with a compass that points towards reliable information and a discerning perspective. That's exactly what I am bringing you today.

In this newsletter series I will analyze and interview one of the best Crypto Investors the CT has ever heard of. Today we will start with Linn (@crypto_linn). Over the past years, Linn has been sharing her insights, strategies, and thoughts on the crypto market in her series of Ledgers and Leverages. These digital chronicles offer a deep dive into her investment philosophy, portfolio, and predictions with Ledger being ever more focused on small-cap plays.

But what makes Linn's Ledgers truly special? It's her commitment to transparency and her nuanced understanding of market dynamics. Our explanation of her newsletters will allow us to better understand not just the current state of the crypto market, but also learn how to navigate it wisely.

In the forthcoming sections, we will delve into Linn's investment philosophy, her analysis of the current market state, the specific coins she's tracking, her daily routines, and her projections for future market trends.

Whether you're a seasoned crypto investor or a newcomer in the digital currency world, the deep dive into Linn's mind will give you valuable lessons to navigate your crypto journey.

Disclaimer: I strongly advise you to subscribe to Linn's Ledger and benefit from the golden alpha she provides. I won't disclose too much information from the Ledger so u would have the possibility to dive into the details yourself.

Who is Linn?

Linn is only a spiritual adviser, just kidding. Linn is a Crypto Influencer, investor, and ambassador of many projects like Byte Masons, Thena, and Pendle. As mentioned earlier she is a creator of 2 very popular newsletters Linn's Ledger and Linn's Leverage

.

Her crypto journey started with $HEX, then $UNI airdrop, and everything else u could imagine. Terra's crash was the turning point for her as she lost a fortune there. She was also impacted by Celsius but after that, she decided to make everything back, that's how her CT journey started.

I had luck being able to ask Linn some questions, each part will contain a couple of insides from her

Decoding Linn's Newsletters: Key Takeaways

That's where all alpha is being found. Linn has built her routine in a way that she always knows everything about the projects she is interested in/holding.

She built 3 Twitter Lists: Alpha, Beta, and Gamma. Alpha is being read twice a day and Linn makes sure not to miss anything. If the day is calm/not enough alpha Linn might also consider looking into Beta and Gamma lists to get as much recent info as possible. Linn explains that it's all about the patterns the brain starts recognizing. U see what kind of announcement was made, how the price reacted and that's how u build those connections and the ability to make some predictions with high conviction.

Health

It's also important to maintain a healthy lifestyle and strong mental health.

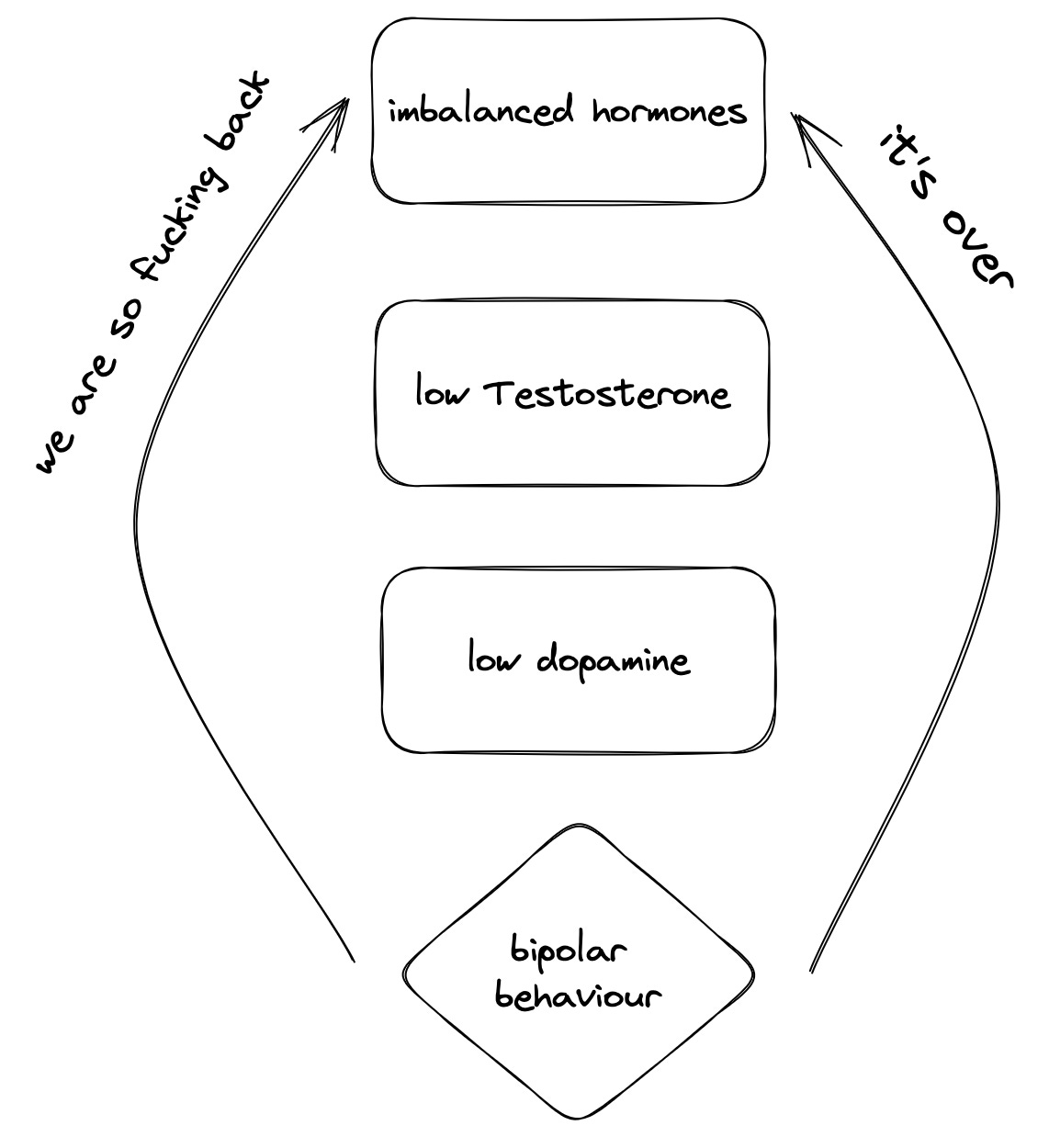

There is a simple chain of how it works:

Making risky financial decisions is very similar to other biological activities we do. But when your health is at risk u might become biased

A healthy endocrine system is key to a steady serene mood during pumps and dumps. We are largely motivated by our neurotransmitters and hormones. If we stay healthy and the hormones are optimized, we are much more likely to reduce the bipolar activity so that regardless of external outcomes we stay calm and collected.

Persistence

It's very important to understand that u can't be successful if u are not consistent, especially in crypto. Linn says that crypto is a game of attrition.

We must stay in the game, many investments will go down but pick the right one and they will go up multiple times. It's a generational opportunity and u are wasting time on what? U can't win if u are not ready to pay the price.

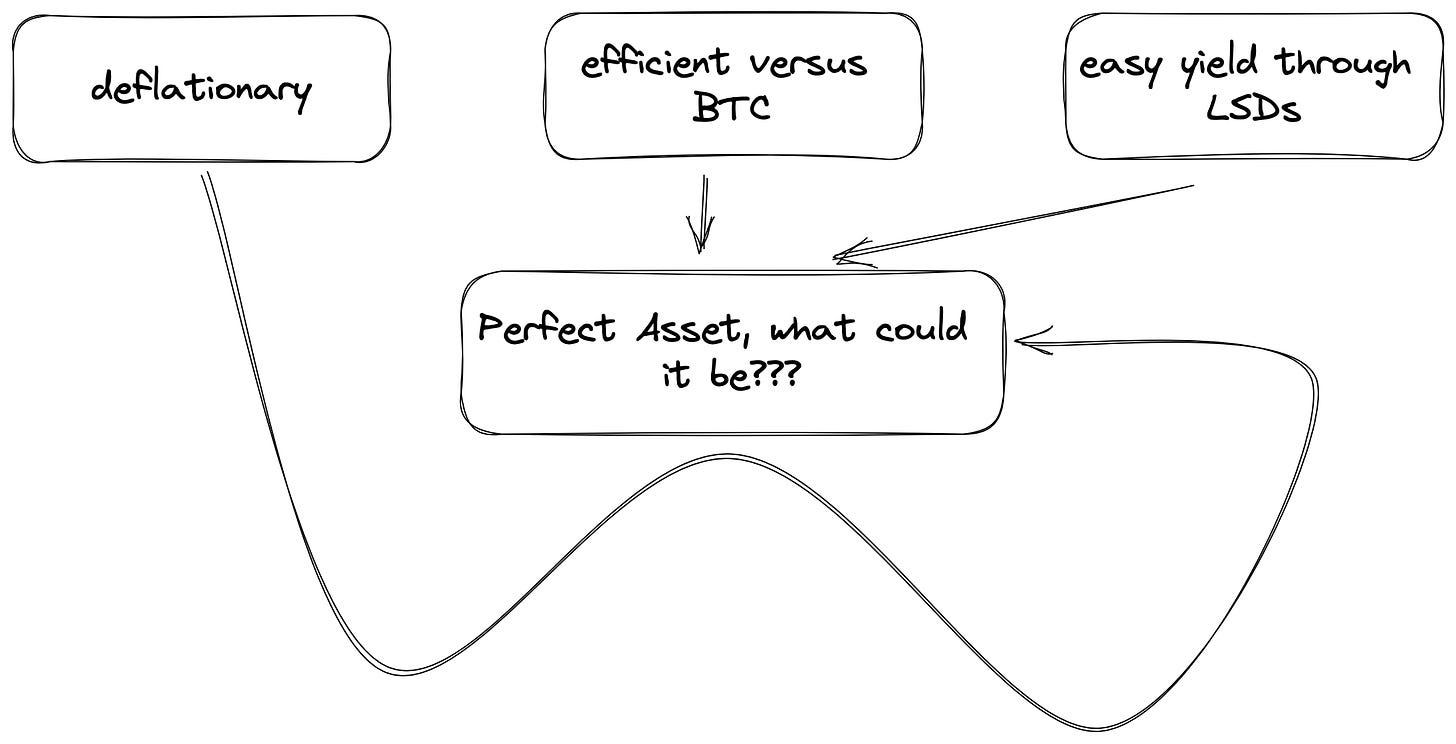

It's also important to understand why and what are u buying. Stay nimble in what u invest, as Linn does. Go read Bitcoin Whitepaper and Ethereum Whitepaper, truly understand how it works, how $ETH can generate yield, etc. Before buying $PENDLE go through the docs a couple of times, understand how it works, the benefits, and the risks involved.

CT Life

If u believe in yourself and want to outperform $ETH u need to understand certain things clearly. The reason why Linn is not biased, and confident is because:

Longer time frame Investment

Money to survive the bear market

Understanding why crypto is here to stay

When u understand that u are operating over a 2-3 years time span, u can survive the bear market and have enough money for runaway. After understanding crypto not going anywhere and fundamentals u become truly invincible. The secret to unlocking anything: doing.

Linn's Investment Philosophy

Linn's investment philosophy is deeply rooted in strategic and thoughtful decision-making. Here are the key components:

"Outpace or Die"

Linn believes that the main goal of any active investor should be to outperform Ethereum. It's kind of a benchmark every investor should surpass. She encourages either investing in $ETH or finding lower-cap plays that have the potential to outpace it. Either u are a passive $ETH holder with a conservative 5-8x in the coming Bullrun or u are trying to outperform which might take a lot of time and effort but not beating it would be equal to financial death.

Emphasizing Discipline and Patience

Linn echoes the wisdom of legendary investor Peter Lynch, emphasizing the costliness of trying to anticipate market corrections. Linn recommends focusing on long-term investment strategies over short-term market fluctuations, urging investors to stick to their plans even during volatile periods.

Avoiding the Loser's game

Very important advice from Linn is not to speculate too much on individual assets and put too much faith in meme coins. She views them as high-risk, equating most to gambling with odds heavily skewed towards the founders. Instead, she encourages focusing on minimizing investment errors and adopting a strategy that's more about avoiding loss than seeking spectacular gains. It's mainly not about how much we earn, it's about how much we don't lose.

Favoring Ethereum over USDC

This one was pretty interesting for me because in my opinion what Linn does is very unusual. Linn has built significant income from the Newsletter and she tries to convert as much as she can into $ETH. If it dips she buys, if it grows she buys. Generational wealth is being accumulated.

The Importance of Diversification

As we know Linn loves $ETH but still, she diversifies enough to play with lover caps as $PENDLE and $OATH. It's not about holding 100 coins, it's about finding a place in your portfolio for most conventional investments. During the Ledger series, the number of coins held shrunk which allowed Linn to concentrate better on the held ones.

Question your portfolio

Just ask yourself: "If $PENDLE dumps/pumps would I be happy?". You might be asking yourself: "How could I be happy if smth dumps?". The $ETH will make 5-8x conservatively and u are not happy it's dumping? It's about your convictions, expectations, and strategy, question your assets and adjust accordingly.

Having that in mind still try not to overmanage. The best portfolios are those that you can leave for a few months, come back and hey, I’m up. Over-trading is a rookie mistake and loses the majority of people's money

.

Market inefficiency

Yep, you heard it right, the market is inefficient and u need to learn how to use it to your advantage. Adapting and profit is the only strategy. Memecoins might seem very inefficient but people love gambling so here they are. Accept them and find ways to profit.

High risk != High reward

When it comes to investing(and overall), you can often hear that high risk is high reward. However, that is not always the case. Paying a higher price for something that has already been de-risked can sometimes be a wise decision. In the young crypto world, it's especially true.

Remember, this investment philosophy is not a one-size-fits-all approach. As each investor's circumstances and risk tolerance vary, it's crucial to tailor your strategy to your personal financial goals and situation.

Linn's successful Investment cases

Linn has made a lot of profitable public trades. I would say she is kind of similar to Defi Maestro here. The same way as Maestro played $JOE Linn played $PENDLE. The main takeaway here is that Maestro was playing very short term, flipping from one alt to another and maximizing profits. Linn plays very long-term 2-3 years minimum.

The photo was taken from the #31 Ledger which is available to everyone

Linn is being sponsored by the $PENDLE team which is a beneficial partnership for both sides. Linn simply buys more $PENDLE to lock it and boost the pool rewards, woahla. It's about generational wealth in 2-3 years, not in a couple of months.

Despite her long-horizon planning, she also might play short-term, as she did with $PEPE. Honestly, the call was given, so everyone could make 200-300%. She is very versatile here as meme coins can also offer a great pump opportunity for short-term gains

I think we will see Linn's biggest wins in a couple of years. As I mentioned before, she is a strong $ETH believer and converts as much fiat into it as possible.

2024-2025 is when things will be heating up.

Conclusion

In this exploration of Linn's perspectives, we've navigated through the vast seas of crypto investing, guided by her unique insights and experiences. We've delved into her investment philosophy, unpacked her newsletters, and sought to understand her approach to the dynamic world of cryptocurrencies. From her unwavering focus on Ethereum to her cautious approach towards meme coins, Linn provides a distinctive lens through which to view the crypto landscape.

While the crypto market is marked by its volatility and unpredictability, Linn's long-term, disciplined approach serves as a reminder that investing is not a get-rich-quick scheme. Her focus on minimizing mistakes, rather than trying to outperform the market, provides a valuable lesson for investors.

Ultimately, Linn's approach to crypto investing is a testament to the importance of patience, discipline, and strategic thinking in this rapidly evolving space. As the crypto market continues to grow and mature, her insights are a valuable resource for any investor navigating this exciting yet challenging landscape.

I hope this exploration of Linn's investing philosophy and strategies has provided you with valuable insights and perspectives. As always, remember that investing carries risks, and it's crucial to do your research and understand your risk tolerance before making any investment decisions.

Thank you for joining us on this journey into the world of crypto investing as seen through Linn's eyes. Until next time, happy investing!

Subscribe

If you've found this deep dive into Linn's crypto investing strategies insightful, join for more! Subscribe to this newsletter to receive regular research, interviews, and much more.

Don't forget to subscribe to Linn's Newsletters too. I hope u could have realized already how much alpha can be found there.

love the visuals!