Ultimate on-chain analytics guide 🐳

Be a king of on-chain analysis

Introduction

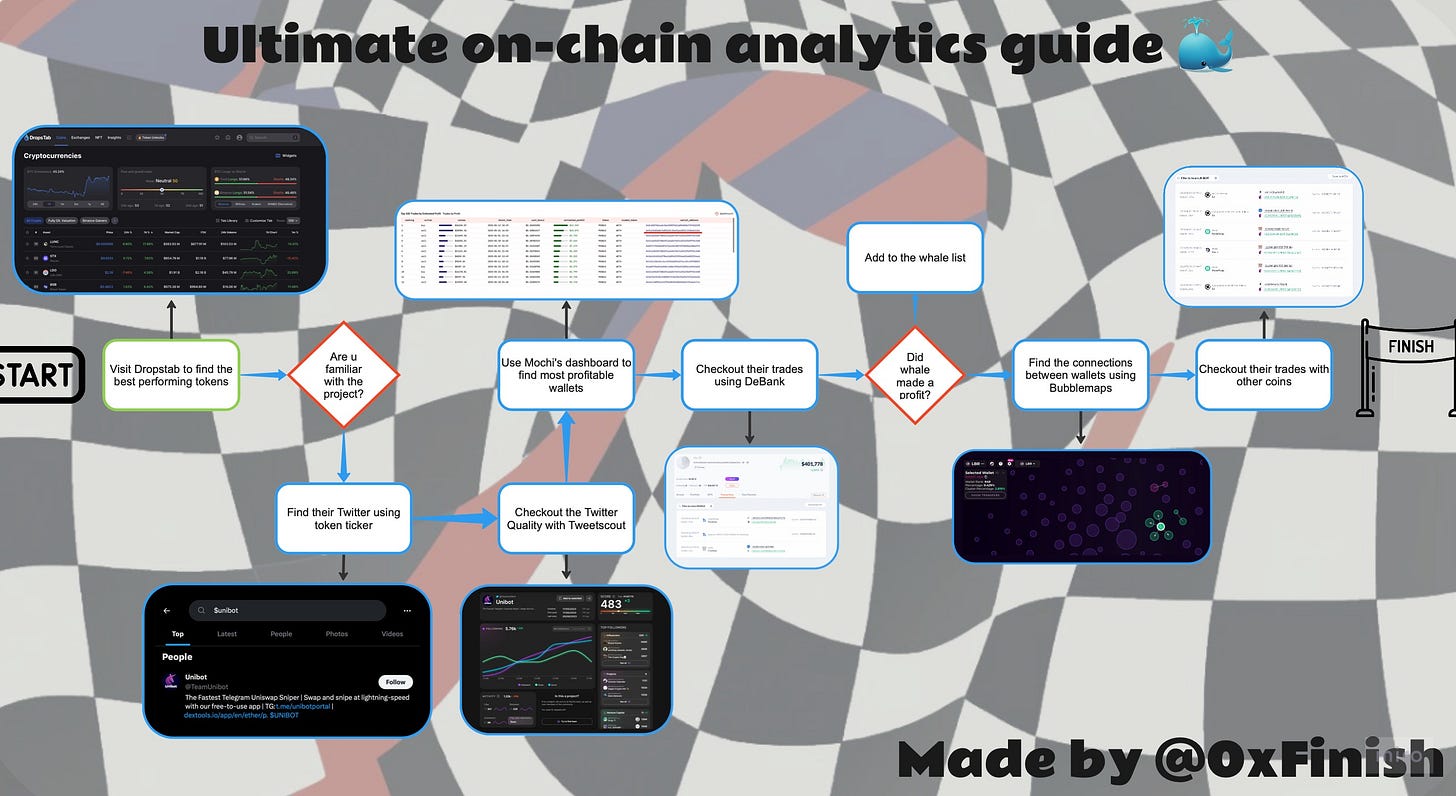

In this ultimate guide, we will learn how to find whales, how we can track their transactions, and be as early as they are. I have built an ultimate Dashboard so you would always know what to do.

Find a Whale (LBR, PENDLE)

As you may know, the most important part of tracking the whale is to find it. From millions of ETH addresses, we want to find the most profitable, the earliest one. A lot of on-chain tools like DeBank, BubbleMaps, and Dune are must-haves here. Even Twitter can be used for this purpose as there are a lot of threads where people are “tracking whales”, I will show you how to do it the right way 🤝.

Here is the list of whales we will be tracking today:

Yep, only one. As the guide goes on I will tell you how to find them on your own and grow the “whales database”.

Check the plays

Before classifying the wallet as a whale we really need to be sure that he did something profitable, which is worth following. We don’t want to just follow the plays of some lucky guy. In this part, we will analyze the whale plays and decide if he is worth following.

We are not really interested in the past but the past is what influences the future.

Obviously, we can't ride $LBR, $PEPE, and other coins again, but the wallets that successfully did can do it again with new projects. That's exactly what we aim to do. I don’t want to write about “Oh look this wallet was made 100x”, you can’t earn from it, only get FOMO.

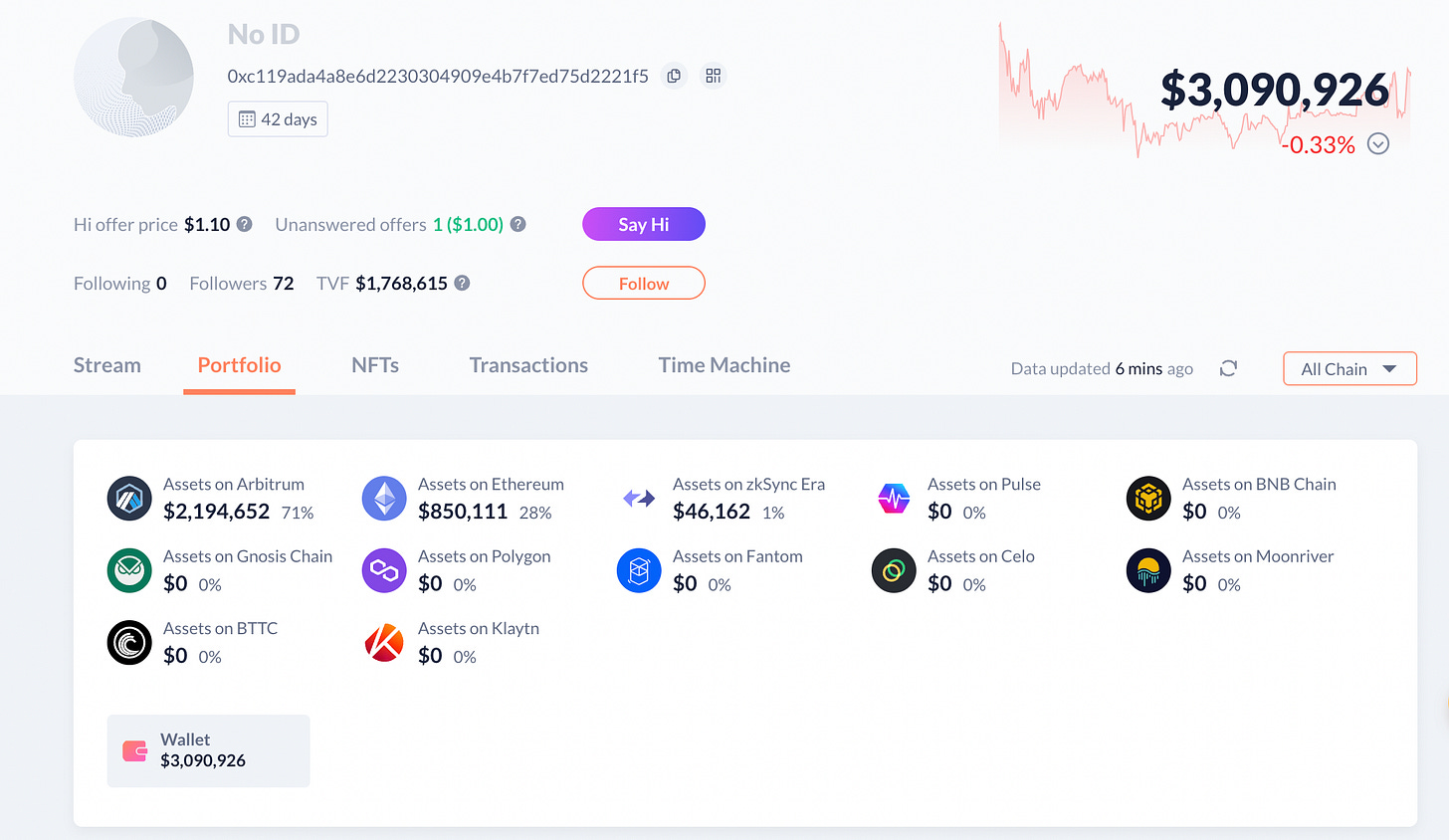

After we have gathered some whales, we can take a look at their “plays”. The best place to do it is Debank as you can easily see all the assets around different chains and the protocols they have used.

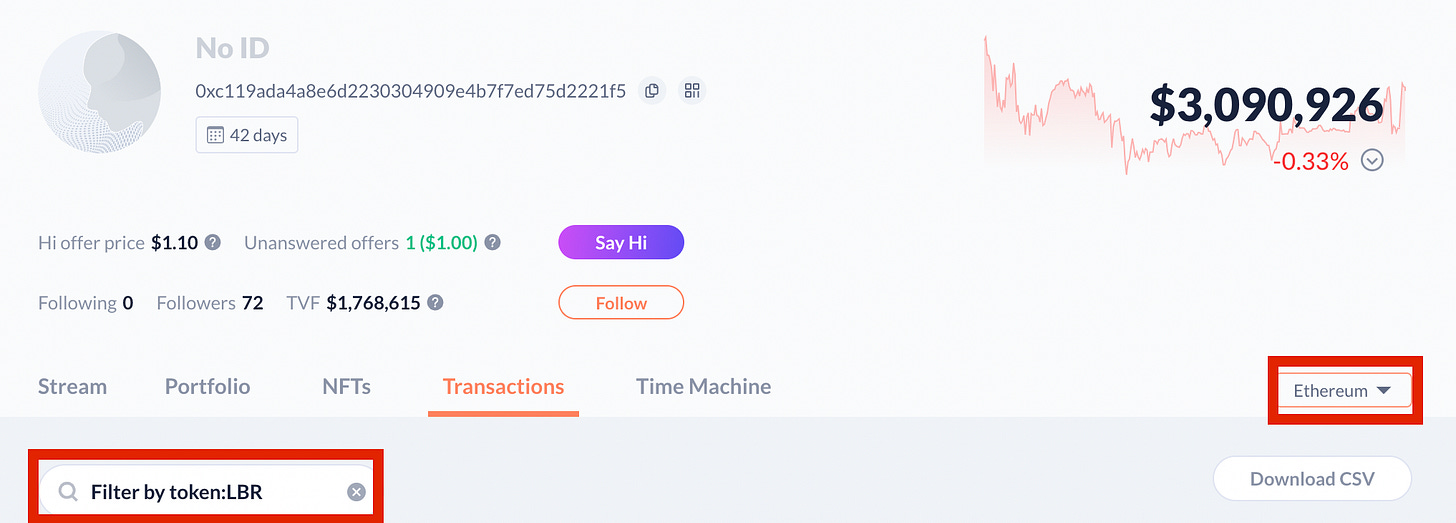

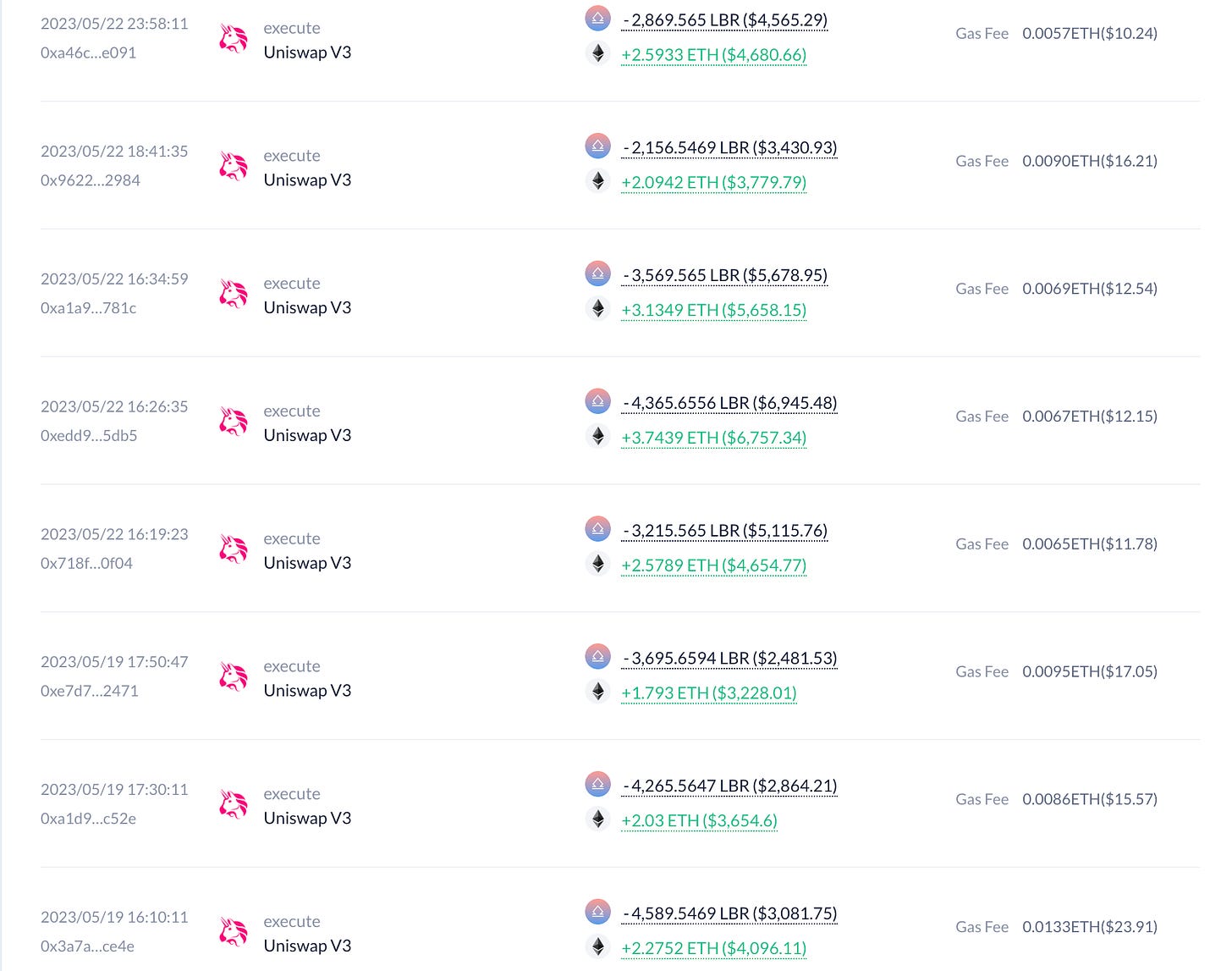

Another excellent feature is to sort the transactions by any chain or any specific token, which is exactly what I will be doing in the next section.

Now that we have the wallets let’s check out their plays. Will start with the first one. I chose him because he was very early to ape into Lybra and earned a lot.

Another awesome tool we will be using is DEXScreener, which allows you to easily find any alt-coin on any EVM chain in just a couple of seconds and jump into trading.

As we can see this whale would make 20x if he sold the top. Unfortunately, he was too early to sell and did “only” 7x here. Still an awesome result and some massive gains, I would definitely add this one to the “whales”.

Now we know that the wallet was early and made decent profits, already worth noting it. But can we go even further and inspect the other plays?

Before even apeing into Lybra this whale bought some $CHOKE from Artichoke and you can see the profits yourself, another superb play. After that, he didn’t bought anything else, so I am waiting for his next play.

Find a partners

Whales often have connections to other whales, let’s imagine we have only this one and try to find other profitable whales. The wallet of the first whale was initially funded by 0x61d7c6572922a1ecff8fce8b88920f7eaaab1dae.

As we can see this is an even bigger whale with ~$5m in assets. Now we want to see if this whale did any smart plays.

We can see that the 2nd whale brought Lybra even earlier, even before the migration. So now we got a connection between 2 profitable whales, maybe they bought something profitable recently? This particular whale didn’t do many plays recently, maybe we can find other ones.

Bubbleamaps is the next tool we will use. It helps to find the connected wallets, so we could track them even better, let’s see what we will find.

Yep, we found them, we can see how 2 whales have been transferring $ETH between each other and their child wallets.

If we will switch to the $LBR we will find even more children with almost 3% of the total Lybra supply being under the control of these wallets, mindblowing. But it seems as if we are stuck as those wallets are not doing any new moves, so what do we do next?

Dune is love 🫶

Dune is one of the most awesome tools for on-chain analytics, if you know SQL, you would be a god of crypto, as Mochi is. She did a ton of awesome dashboards but my favorite is Token analyzooor. Let’s think which token had a good pump so people could profit. IMO, if you are thinking too long you don’t hold $PENDLE from Pendle Finance as it was pumping the whole week now.

After we chose a token we need to make sure that we input all parameters correctly. Copy the $PENDLE contract in the Etherscan, fill in the time period you want to inspect and the chain ( Ethereum for us ) and then just click the button “Apply all parameters”

I have found this wallet very interesting as this whale is trading almost daily and we might find some new plays we could have missed. Let’s dive in.

The whale just did one buy and one sell but with the perfect timing, making him one of the most profitable $PENDLE traders in the last 30 days.

One of the last trades the whale did was with $UNIBOT and I have never heard of it, finally, we have found some alpha, let’s dig into what that is. We have a contract address, how can we find any information about the project? That’s where Twitter comes into the game as every project has a Twitter account, let’s see how we can find it.

Done through the research whole

All I needed to do is just search for a token ticker on Twitter and I was instantly able to find it. Seems like it’s a telegram bot to snipe the tokens on Uniswap, interesting. With every crypto project the most important part is the community, how can we be sure that Unibot has a good following?

I am using Tweetscout to check the quality of Twitter accounts, you can instantly check if the account has bots or is organic. Unibet is super legit and has a very high score, we can surely look into it further.

The next thing we could do would be to check the connection of this whale to others, that’s how this loophole functions and you can go on and on to find the most fresh coins. This wallet is the 14th largest holder but doesn’t have any connections to others.

The last thing we might do is to check the liquidity and the price action using DEXScreener. Looks like the project has a solid mcap of $15.2M and has seen a massive price increase since the TGE.

Conclusion

And that’s it, chads!

That’s how you can find the best alpha using the on-chain tools I showed you. Make sure to use the Dashboard I created to always know your next step. The opportunity is always there and everyone can find it, everything is in your hands friends.

Links/Sources

Dashboard with all analytic tools

Awesome Dune dashboards from Mochi

Nice!

Thank You