Frax V2 and Fraxchain about to dominate the DeFi

With the recent development of Frax Finance we might see new the LSD champ🍾

Introduction

Hi, dear member of the Racing Crypto Club 🤝

Welcome to another issue of Racing Crypto Club, where I aim to demystify the complex but fascinating world of decentralized finance. If you missed my previous coverage on Frax Finance, don't worry, as I'll provide a quick recap before we dive into the latest updates from this dynamic protocol.

To give you a brief introduction, Frax Finance is an ambitious project established by Sam Kazemian, Travis Moore, and Jason Huan. The cornerstone of this protocol is the $FRAX stablecoin, but their toolkit extends beyond that, featuring innovative products like FraxSwap DEX, FraxLend money market platform, and FraxFerry, a bridge for easy transfer of Frax assets. With this potent suite of products, Frax Finance has made impressive strides in the ever-evolving landscape of DeFi, providing stability, efficiency, and fresh ideas in the often unpredictable world of cryptocurrencies.

Now, if that has piqued your interest, let's dive into some exciting developments. The team behind Frax Finance has been hard at work, pioneering major updates and improvements to their protocol. In the spotlight today are three key innovations: the second version of frxETH (frxETH V2), the Time-Weighted Automated Market Maker V2 (TWAMM V2), and a brand new Layer 2 solution - Fraxchain. Each of these elements brings something unique and valuable to the Frax ecosystem, so let's unpack them one by one and explore what they mean for the future of Frax Finance. Buckle up for an exciting journey into the heart of DeFi innovation!

Intro to the Frax Ecosystem

In our last conversation, I briefly introduced Frax Finance, but this time, let's delve deeper and explore the actual products powering this ecosystem.

Before I start, if you want an even deeper overview, make sure to read my last Newsletter on Frax 👇

Frax Finance

Introduction The decentralized finance (DeFi) sector has revolutionized the way we interact with financial systems, pushing the boundaries of traditional finance into a world of trustless and permissionless innovation. Amidst a plethora of DeFi protocols, a name that has gained significant attention is Frax Finance.

Frax Finance is not a one-trick pony. It offers a range of financial services, each solving a unique problem in the DeFi space. For starters, we have $FRAX, a stablecoin that keeps a consistent value pegged to the US dollar. Its unique design offers the best of both worlds: it's partially collateralized by USDC, and also partially algorithmic, meaning it can dynamically adjust to market conditions.

Next, we have Frax Share (FXS), the governance token of the ecosystem. Holders of FXS have the power to vote on various proposals and guide the development of the Frax ecosystem. This embodies the true spirit of decentralization, where the decision-making power lies in the hands of the community.

Then there's FraxSwap, a decentralized exchange (DEX) built by Frax Finance. But it's not just any DEX - FraxSwap is a pioneer, being the first to implement a Time-Weighted Automated Market Maker (TWAMM). Large orders can be processed over time to prevent significant price impacts, a novel feature in the DeFi world.

For those interested in lending and borrowing, Frax Finance provides FraxLend, a platform where users can borrow FRAX against their assets. And lastly, to aid in the cross-chain transfer of assets, FraxFerry stands as a beacon, ensuring liquidity flows smoothly across the different chains supported by Frax.

These are just some of the key elements of the Frax ecosystem. I'm sure by now you can see how Frax Finance is not just another DeFi protocol, but a complete financial system in its own right. Up next, let's take a trip down memory lane and see how Frax Finance has evolved over the years to its current standing.

Ouroboros Capital did super informative graphic on how previous big milestones in terms of Frax Ecosystem development have influenced the Frax Share and it looks like we might see a massive run up as sooo many awesome things are being shipped 🐳

Frax Journey

As we sail further into our deep dive of Frax Finance, it's important we take a moment to glance in the rearview mirror. Understanding the path that led us here allows us to truly appreciate the innovations Frax has introduced to the DeFi world.

From its inception in mid-2019, under the moniker Decentral Bank, Frax Finance has always been a beacon of innovation. The founders - Sam Kazemian, Travis Moore, and Jason Huan - had a vision of creating a robust, decentralized finance protocol. And, boy, have they delivered on that promise!

The flagship product of the project, the $FRAX stablecoin, hit the ground running as the first partially collateralized and partially algorithmic stablecoin in the industry. While it may now be fully collateralized following the fall of the algorithmic stablecoin, UST, it bears testament to the bold and daring spirit that is at the heart of Frax Finance.

From there, the team didn't just rest on their laurels. They continued to push the boundaries of innovation, launching a suite of products that significantly expanded the Frax ecosystem. The FraxSwap DEX, FraxLend, and FraxFerry all debuted, each serving a unique purpose and contributing to the growth and maturity of the platform.

Fast forward to today, Frax Finance stands as a prominent player in the DeFi space, continually expanding, innovating, and impressing the crypto community with its solutions. The journey so far has been nothing short of remarkable.

Now that we've reminisced a bit about the past, it's time to steer our attention back to the present and peek into the future. What's next on the horizon for Frax Finance? Well, let's find out!

The Next Phase – Exciting Developments on the Horizon for Frax Finance

After getting a sense of where Frax Finance has been, it's now time to turn our gaze to the future. If you thought that Frax Finance was going to take a breather, you're in for a surprise! The team is not only maintaining its momentum but is actually stepping on the gas.

$frxETH V2

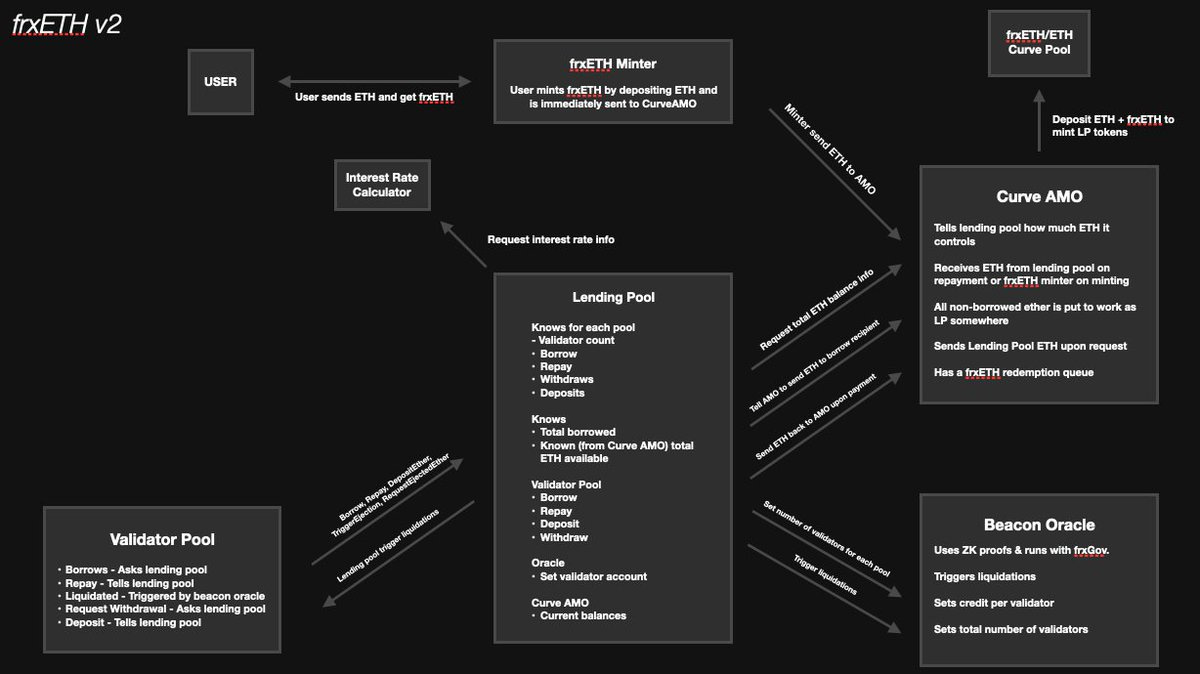

Perhaps one of the most significant upcoming updates for the Frax ecosystem is the frxETH V2. As we know, frxETH was Frax's answer to liquid staking derivatives (LSDs). This solution initially allowed users to deposit their Ethereum into the protocol and receive frxETH in return, which could then be used within the DeFi ecosystem while still earning staking rewards.

The updated frxETH V2 takes this a step further. With this new version, Frax Finance is essentially treating all LSDs as lending Ethereum to validators, with the "interest" being the staking rewards. This frames frxETH not just as a staking derivative, but as a lending mechanism as well.

Frax V2 proposes that deposited ETH in Frax would be lent out to Ethereum node operators, who would put up the required collateral and pay a certain interest rate in order to borrow the ETH from Frax Finance. The interest payments on this loan will be paid out to frxETH stakers as yield. This change in approach could have significant implications for the utilization of Ethereum and staking rewards in the DeFi ecosystem.

So far Frax nodes have the best uptime among all LSDs and the upcoming update will make it even more stable and secure. As we have seen previously the number of nodes is raising constantly which makes the Frax LSD network even more decentralized.

Furthermore, $sfrxETH (staked $frxETH) has been showing the best performance compared to market leaders like Lido and RocketPool with a whopping 56.25% better return than $rETH. This is made possible via a unique 2 tokens system where only $sfrxETH is getting the yield which makes it an attractive place to park your $ETH.

Fraxchain

The other major update is the introduction of Fraxchain, a layer 2 solution that Frax is developing. Fraxchain promises to be a hybrid rollup, combining optimistic rollups and zero-knowledge proofs (zk-rollups). This marriage of technologies seeks to deliver a solution that is both scalable and secure.

The exciting twist is that frxETH will be used as the gas token on Fraxchain. This means that every transaction and contract interaction on Fraxchain will require frxETH, which is a bold and significant departure from the common use of ETH as gas in the Ethereum ecosystem. The decision to use frxETH as gas on Fraxchain could have a profound effect on the utility and demand for frxETH.

Furthermore, the introduction of Fraxchain could have far-reaching implications for the use of Ethereum in DeFi. Reducing gas costs and increasing transaction speed, it could lead to an even broader adoption of DeFi products and platforms. At the same time, it presents a unique and exciting challenge to existing L2 solutions in the market.

In conclusion, the combination of $frxETH v2 and Fraxchain, along with the upcoming Frax app, represents a powerful leap forward for Frax Finance. Each of these developments showcases the team's commitment to pushing the boundaries of DeFi and carving out a unique and innovative role in the ecosystem.

Make sure to check out the interview with Sam Kazemian to get even more insights on the upcoming Fraxchain 👇

Wrapping Up and Looking Forward

As we come to the end of this deep dive into Frax Finance, let's take a moment to recap the key points and discuss what these upcoming developments could mean for the project and the wider DeFi landscape.

Frax Finance has always been an innovator in the DeFi space, pushing the boundaries and exploring uncharted territories. The project's native decentralized exchange, FraxSwap, was a game-changer. It introduced a time-weighted automated market maker (TWAMM) model to the market, enabling large orders to be processed over time without significant price fluctuations.

Looking forward, the next significant phase for Frax Finance is filled with exciting developments. The $frxETH v2 brings a novel way of viewing and leveraging LSDs. Fraxchain, a hybrid rollup layer 2 solution, is poised to enhance scalability, speed, and security, offering an L2 solution with its own unique twist. The upcoming Frax app promises to make navigating the Frax ecosystem simpler and more intuitive.

With all these in mind, the future of Frax Finance looks promising. If they successfully implement these upcoming updates and continue to innovate, they could further solidify their position as a leading player in the DeFi sector.

For anyone interested in DeFi, these are definitely developments worth watching. So, let's keep our eyes peeled for what's to come in the next phase of Frax Finance!

I will keep you updated for sure, frens 🫶

Your Next Steps in the Frax Journey

It's been quite a journey exploring the Frax ecosystem, its accomplishments, and the exciting developments on the horizon. I believe we're standing on the precipice of some groundbreaking advancements in DeFi, and Frax Finance seems poised to be a significant player in that narrative.

Remember, the DeFi space moves quickly, and it's always the early adopters who stand to benefit the most!

I hope you've found this deep dive into Frax Finance insightful and engaging. Let's continue to explore and learn together in this ever-evolving DeFi landscape.

Until next time, dear member of the Racing Crypto Club!

Links/Sources

Great Thread from Riley_gmi